Investor psychology: control your emotions in the financial markets

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” – John Templeton, American-born British financier and philanthropist.

God’s portfolio and market volatility

Imagine having access to a time machine. You can travel to the future and discover which stocks will be the winners of the next five years. This premise, seemingly straight out of a science fiction novel, is the central theme of one of the most fascinating studies by Alpha Architect, published in February 2016: “Even God Would Get Fired as an Active Investor.”

Alpha Architect proposes a hypothetical experiment: What would the result be if a visionary investor could pick the best-performing stocks among the 500 largest NYSE/NASDAQ/AMEX companies every five years from 1927 to 2016? An average annual return of 29%! This number would make the most successful fund manager pale in comparison.

But there’s an unexpected twist in this perfect narrative. Despite its omniscience, “God’s portfolio” also faces the harsh reality of the markets: brutal volatility. During this period (1927-2016), it would have experienced a maximum drawdown of 76% and multiple corrections of over 20%.

It’s a financial thriller: the perfect investor, with the ideal strategy, would have to endure sleepless nights, constant doubt, and the ever-present fear that his world might collapse. The lesson is clear: not even absolute knowledge can protect us from the emotional onslaught of volatility.

While the figures of “God’s portfolio” remind us of the potential of the markets, they also warn us of their greatest trap: our own mind. In the following sections, we will explore overcoming these psychological challenges to become resilient and disciplined investors.

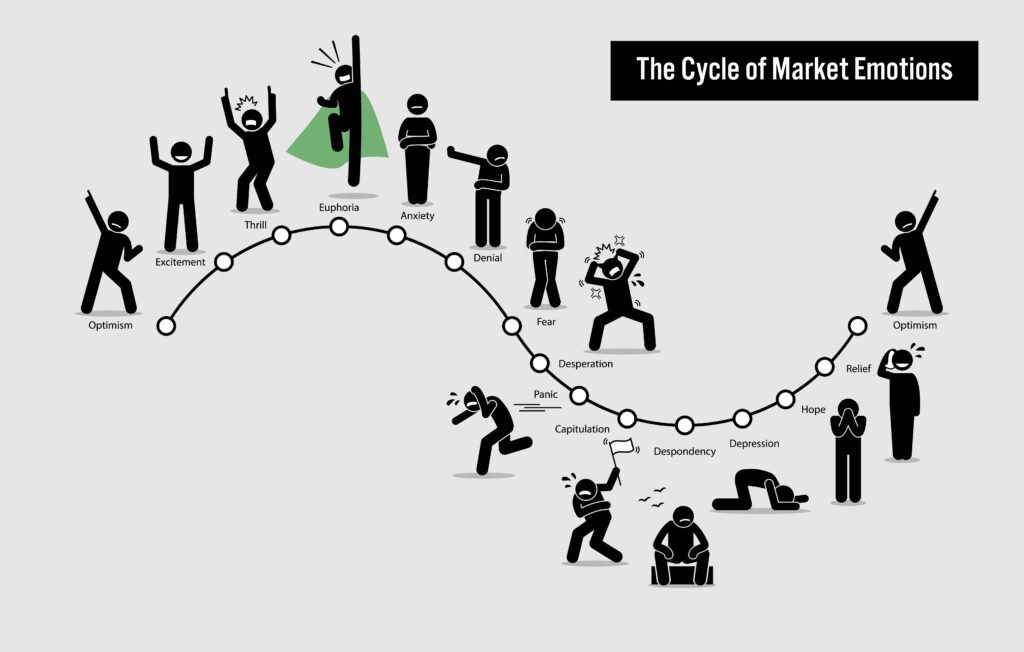

Fear and greed: the market’s invisible players

In the vast and chaotic landscape of financial markets, there are two forces that, although invisible, exert overwhelming power over investors’ decisions: fear and greed. Like actors in a Greek tragedy, they alternate the lead, leading the audience – the investors – to experience extremes of euphoria and panic.

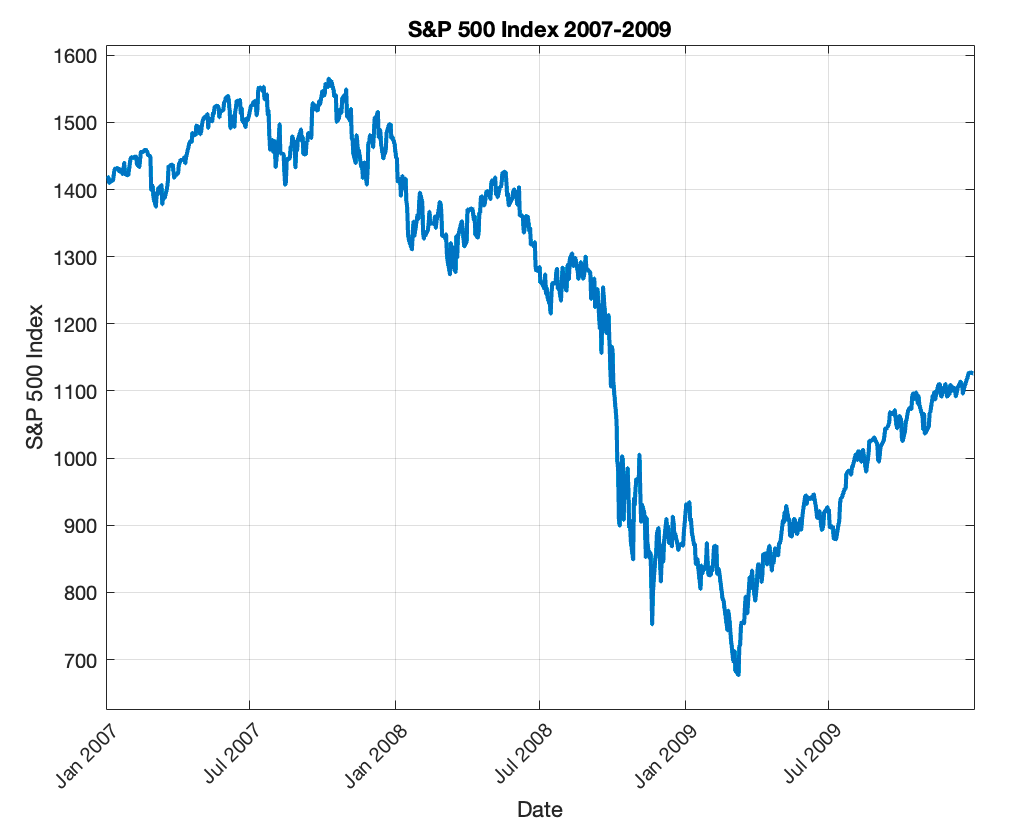

The housing bubble of 2008 is a paradigmatic example of uncontrolled greed. For years, housing prices rose relentlessly, fueled by subprime mortgage lending and blind confidence that “house prices will never go down.” Banks packaged these mortgages into complex financial products, bought by investors eager for quick and high returns. Greed led to ignoring the latent risks, while financial institutions and speculators continued to inflate a bubble destined to burst.

When the collapse finally came, fear invaded the scene with devastating force. Investors, terrified by the magnitude of the losses, began to sell their assets en masse, intensifying the market plunge. The S&P 500 index fell nearly 50% from its 2007 peak to its low point in March 2009. Headlines announced the bankruptcy of Lehman Brothers and the collapse of major banks, generating an atmosphere of panic that affected not only the markets but also global confidence.

“The greatest danger is not the uncertainty of the market, but the uncontrolled emotions of investors,” says George Soros, encapsulating the essence of these dual forces. The moral is clear: in this theater, success belongs not to those who unquestioningly applaud the actors of fear or greed but to those who calmly observe, analyze, and keep control of their emotions.

Biases that sabotage your decisions: internal enemy or unavoidable reality?

Our decisions are not always guided by reason in the intricate maze of financial markets. More often than we want to admit, emotions and biases take over. These invisible enemies sabotage our decisions, erode our potential, and steer us away from our financial goals.

Loss aversion: why does fear outweigh hope?

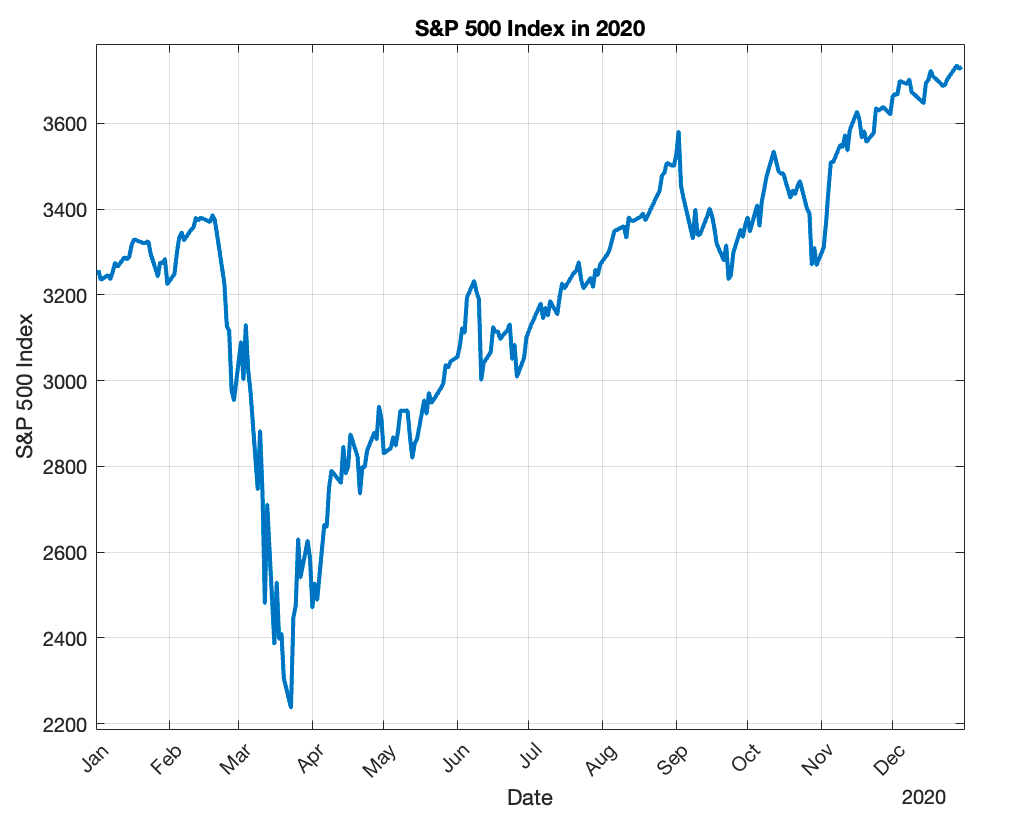

Psychological studies have shown that losing money hurts about twice as much as the joy of winning it. This bias, known as loss aversion, can lead us to hold losing investments too long or sell winning positions prematurely. A recent and telling example is the 2020 pandemic.

In March 2020, the S&P 500 index fell 34% in just five weeks, triggering panic among investors. Many sold at the worst possible moment, fearing further losses. However, those who remained calm saw the market recover quickly, reaching new all-time highs in August of the same year. The lesson is clear: loss aversion can lead to rash decisions that prevent us from benefiting from market rallies.

Overconfidence: when your certainties lead you astray

“The investor’s greatest enemy is usually himself,” warned Warren Buffett. Overconfidence can be as dangerous as fear. Many investors overestimate their ability to predict the market, leading them to take unnecessary risks or ignore diversification.

A clear example is the technology boom of the 1990s when investors believed that everything related to dot coms was a gold mine. In the end, the bubble burst, and the results were devastating.

Creep effect: the trap of following the crowd

In 1637, a flower fetched as much as a house during the famous tulip bubble in the Netherlands. This historical episode is the most extreme example of the bandwagon effect: when we follow the crowd without questioning whether the price reflects the actual value. Today, cryptocurrencies have generated similar episodes, driven by the fear of being “left out.”

Know your biases and protect your investment

The battle against biases is constant but not unwinnable. The key is to know yourself, identify your weaknesses, and develop a strategy that mitigates their impact. As Charlie Munger said, “A great investor is not someone without fears or mistakes, but someone who manages them better than everyone else.”

Remember! Your biggest enemies are not in the market but in your mind. Master them, and you will be one step closer to financial success.

Strategies to shield your emotions: be the investor who rides out the storm

In the heart of financial chaos, investors need an anchor when markets roar like storms and emotions threaten to boil over. That anchor is the ability to shield emotions, a skill that separates those who succumb to panic from those who thrive under pressure. It’s not just about numbers here but about mastering the mind to make rational decisions at the most critical moments.

Below, I’ve included tips to tame your emotions and become a rational, conscious investor immune to the vicissitudes of the financial markets.

Planning, strategy, and discipline

A clear investment plan, based on objectives rather than impulses, acts as an anchor in times of volatility and is the most effective shield against destructive emotions. Set specific goals: what do you want to achieve with your investments? Also, define your rules: when to buy, sell, and how much you will lose before you act. This approach protects you from impulsive decisions and lets you stay focused even when markets seem to collapse.

“If you don’t know where you’re going, any road will take you there,” said Lewis Carroll. In the financial world, that road is often filled with losses.

2. Automate your decisions: eliminate the human factor.

Stop-loss orders and automatic limits are your best allies to prevent fear or greed from intervening at critical moments. These pre-programmed decisions act like autopilots, keeping you on course amid turbulence.

3. Diversify: don’t put all your eggs in the same basket.

Diversification is not only a financial strategy; it is an emotional lifeline. By spreading your investments across different assets, sectors, or geographies, you reduce the risk of a single unfavorable event sinking your portfolio. In 2008, those with diversified portfolios felt the impact of the crisis but were not completely wiped out.

4. Strengthen your mindset: Continuing education and mindfulness

Knowledge is the best defense against the unknown. Spend time understanding how markets work, studying historical cases, and learning from others’ mistakes. Also, incorporate practices such as mindfulness or meditation to improve your self-control. In the markets, a calm mind is a powerful mind.

5. Adopt a long-term perspective

Markets are unpredictable in the short term, but they tend to reward patient investors over the years. Remember the collapse of 2008: although many lost faith, those who remained steadfast recovered their capital and significant gains.

“Staying diversified in the market is more important than trying to predict the exact timing to enter or exit” is a fundamental lesson that great investors always emphasize.

Investment Heroes: stories that inspire

In the unpredictable universe of financial markets, true heroes do not wear capes or possess supernatural powers. Their greatness lies in their ability to remain calm, make strategic decisions, and defy convention. These stories of legendary investors inspire and offer valuable lessons on weathering market storms.

1. Warren Buffett: The Oracle of Omaha

When the market trembles, Buffett becomes an almost mythical figure. During the 2008 financial crisis, while many were driven by panic, he invested in solid companies like Goldman Sachs and General Electric. Not only did he support these companies during critical moments, but he also earned substantial returns thanks to his long-term vision. His mantra, “Be fearful when others are greedy and greedy when others are fearful,” is a famous quote and a strategy that has made him one of the most successful investors in history.

Michael Burry: the visionary who challenged the marketplace

Michael Burry, immortalized in the book and movie The Big Short, is the perfect example of how discipline and deep analysis can overcome market chaos. While everyone was unthinkingly relying on the housing boom, Burry analyzed the data and spotted the cracks in the system. He bet against the subprime mortgage market, and despite facing doubts and extreme pressure, his prediction proved accurate, generating millions for his investors. His story is a reminder that sometimes the greatest act of heroism is to stand firm on the truth, even when the whole world contradicts you.

3. Cathie Wood: the pioneer of innovation

In an environment dominated by tradition, Cathie Wood stood out for her bold approach to innovation. Founder of ARK Invest, Wood bet on disruptive growth and technology companies such as Tesla and Zoom long before they were widely accepted. Although her investment style has been questioned for its high volatility, her ability to identify long-term trends proves that vision and conviction can generate extraordinary results.

George Soros: the man who broke the Bank of England.

In 1992, Soros made one of the boldest financial moves in history. He bet against the British pound, convinced it was overvalued in the European exchange rate mechanism. His bet was correct, and he made more than a billion dollars in a single day. Although his method was controversial, Soros proved that combining strategic analysis and courage can lead to incredible feats.

Lessons from Investment Heroes

- Long-term view: Great investors look beyond immediate volatility and focus on the big picture.

- Constant education: These heroes are obsessed with learning, analyzing, and understanding the markets.

- Decisions against the tide: Daring to act against the majority takes courage but can be the path to success.

- Emotional resilience: Staying calm amid the storm is a key skill that separates great investors from the rest.

Conclusion: master your emotions, master your investments.

In the vast and tumultuous landscape of the financial markets, emotions are like unpredictable winds: they can propel your sails toward prosperity or sink your ship in the depths of uncertainty. But herein lies the essential truth: you can’t control those winds but can master your boat.

Your mind: your greatest adversary and ally

Benjamin Graham, the father of value investing, put it bluntly: “The smart investor is not someone who beats the market, but someone who overcomes his own emotions.” This statement encapsulates an inescapable reality: financial success is less about technical knowledge and more about the ability to control impulses.

Emotions such as fear and greed are not inherently evil. They are human responses that have helped us survive for millennia. However, in the financial context, they can be disastrous if allowed to run wild.

Key lessons from the past to protect your investments

- A well-defined plan is your anchor in the storm: Design a clear strategy that establishes your financial objectives, risk tolerance, and the rules for buying or selling. This plan should be your guide, especially in times of high volatility.

- Patience is power: In the words of Warren Buffett, “The market is a perfect money transfer machine from the impatient to the patient.” By taking a long-term perspective, you can avoid the pitfalls of impulsive decisions.

- Constantly educating yourself is your best investment: The more you understand how markets work and their historical patterns, the more you can reduce fear and make informed decisions.

- Control your emotions: Meditation and mindfulness can help you manage stress and maintain mental clarity amid chaos. In the markets, a calm mind is a powerful mind. Instead of fighting your emotions, learn to use them to your advantage. Fear can alert you to risks that need assessment; greed can motivate you to seek opportunities. The key is not letting them dominate your decisions but integrating them as part of a rational analysis.

The real victory

Mastering your emotions is more than a financial skill; it is a philosophy of life. It is understood that planning, discipline, patience, and mental clarity are the actual weapons of a successful investor. The real victory is not in avoiding the storms but in masterfully navigating them.

Remember! In this theater of uncertainty called the financial market, it is not about predicting the future but about preparing for it. A calm and trained mind is your best ally to turn volatility into opportunities and challenges into successes.

References for further information

Books

- “The Intelligent Investor“ by Benjamin Graham: This finance classic introduces the philosophy of ‘value investing,’ teaching investors how to develop long-term strategies and protect themselves from significant mistakes.

- “The Behavioral Investor: How Psychology Influences Our Money Decisions“ by Daniel Crosby: This book examines the sociological, neurological, and psychological factors that affect our investment decisions, offering practical solutions to improve both profitability and investor behavior.

- “Smart Stock Market Investing: Strategies and Psychology of the Successful Investor” by Bel Candor: Provides an essential guide to diving into the stock market, combining investment strategies with key psychological aspects to make sound financial decisions.

- “The Psychology of Stock Market Investing“ by Alfonso Álvarez González: Explores the behavioral mechanisms behind stock price movements, helping readers understand and anticipate market behaviors to invest successfully.

These books can be found on Amazon in their paper version, in their Kindle version, or as an audiobook for a subscription to Audible.

The links above are affiliate links, meaning if you decide to make a purchase or subscription through them, the blog will receive a small commission at no additional cost. This collaboration helps us keep the content free, informative, and quality.

Online articles

- The Psychology of Investing: How to Control Your Emotions

Explores how emotions, such as fear and greed, impact financial decisions and offers strategies for managing them.

- Financial Psychology: How emotions affect us when investing.

Delve into how financial psychology influences investment decisions and how to avoid common mistakes stemming from emotions.

- Understanding Investor Psychology: Emotions and Market Volatility

This article explores how investor emotions affect market volatility and the importance of understanding these psychological factors.

- Market Psychology: The 14 Stages of Investor Emotions

Describes the 14 emotional stages investors go through, providing an in-depth view of market psychology.

- How Psychological Indicators Help You Time The Market

Discusses how psychological indicators can assist in timing the market, highlighting the influence of emotions on investment decisions.

Movies and documentaries on Prime Video

- The Big Short. 2015 film chronicles how four investors predicted and profited from the 2008 financial crisis by betting against the U.S. housing market.

- Margin Call. It is a thriller that explores the 24 hours before the onset of the 2008 financial crisis, showing the decisions and ethical dilemmas of an investment bank’s employees as they discover information that could lead to economic collapse.

- Inside Job. Oscar-winning documentary that analyzes the causes and consequences of the 2008 financial crisis, revealing how systemic corruption in the financial sector and politics led to the global economic collapse.

- Enron: The Smartest Guys in the Room. A documentary examining the Enron scandal shows how greed and lack of business ethics led to the bankruptcy of one of America’s largest corporations and affected thousands of employees and investors.

- The Wolf of Wall Street. Based on actual events, this film follows the life of Jordan Belfort, a stockbroker who, driven by greed, engages in fraudulent practices, reflecting the financial world’s excesses and lack of scruples.