Cryptocurrencies and blockchain explained in a simple and clear manner

“Bitcoin will do to banks what email did to the postal industry.” – Rick Falkvinge, founder of the Swedish Pirate Party

Billion-dollar pizzas: the transaction that started the Bitcoin revolution

In the spring of 2010, when the world was still unaware of the potential of cryptocurrencies, a Florida programmer named Laszlo Hanyecz decided to conduct a bold experiment. On the Bitcointalk forums, he proposed exchanging 10,000 bitcoins – a sum shy of $41 – for two family pizzas.

For days, his offer remained in the air, unanswered. The skeptical community watched in silence. Finally, one user accepted the challenge. With growing anticipation, Laszlo transferred the bitcoins, and soon after, his doorbell rang. There they were: two steaming boxes of Papa John’s, a tangible symbol of a digital currency seeking its place in the world.

What seemed like a simple gastronomic transaction then became a historic milestone. Those 10,000 bitcoins barely covered the dinner cost, which would reach over $1 billion today.

Cada 22 de mayo, la comunidad cripto celebra el “Bitcoin Pizza Day”, recordando cómo dos pizzas marcaron el inicio de una revolución financiera que desafía las normas establecidas y redefine el concepto de valor en la era digital.

This story highlights the dizzying evolution of Bitcoin and how small acts can trigger global transformations, leaving an indelible mark on the history of the digital economy.

From two pizzas to a revolution: the epic journey of Bitcoin and cryptocurrencies

The origin of everything

What started as a trivial barter, two pizzas for 10,000 bitcoins, was much more than a transaction; the spark ignited the flame of a silent revolution.

How did a digital currency, created in the shadow of the 2008 financial crisis, grow from a technological curiosity to a global phenomenon challenging traditional financial institutions?

To understand it, we need to go back to 2008. The world was reeling from a financial crisis that exposed the flaws of the traditional banking system. It was in this context of distrust and fragility that a mysterious figure, known under the pseudonym Satoshi Nakamoto, published a document titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

In just nine pages, Nakamoto described a bold idea: a decentralized digital money system without intermediaries based on innovative blockchain technology.

The blockchain, an immutable digital ledger, guarantees the transparency and security of transactions through complex cryptographic algorithms. It was, in essence, a system of trust without the need to trust.

The first steps

On January 3, 2009, Nakamoto mined the first Bitcoin block, the Genesis Block. It contained an encrypted message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” a reference to the bank bailouts of the time. It was more than a financial system; it was a manifesto.

The evolution

During the following years, Bitcoin remained on the margins of society, and it was adopted by a handful of technologists, libertarians, and visionaries who saw in it a new paradigm. Its evolution was slow but steady.

However, things changed when the world began to realize the power of the technology behind Bitcoin: the blockchain. As businesses, governments, and investors recognized its applications, from logistics to digital identity, the concept of cryptocurrencies grew exponentially.

From Bitcoin to crypto economy

Bitcoin was just the beginning. In 2015, Ethereum appeared, introducing smart contracts and expanding the possibilities of the blockchain. Then came thousands of cryptocurrencies, each with specific purposes, from financing projects to revolutionizing sectors such as healthcare and energy.

The present

Today, more than a decade later, cryptocurrencies are no longer a curiosity but an emerging pillar of the global economy. From large corporations accepting Bitcoin as a form of payment to central banks exploring digital currencies, their impact is undeniable.

What began as an experiment to redefine money today represents a profound transformation in how we value, transfer, and understand the economy. Bitcoin and cryptocurrencies have shown that even the boldest revolutions can begin with a single data block.

1. What is blockchain?

Imagine a collaborative archive in the cloud, completely digital, that belongs to the whole community and is open to anyone who wants to consult it. Every participant can see it, but no one can alter it without everyone noticing. This book is unique because it cannot be changed or deleted, and each page contains a detailed record of transactions. To make it even more visual, think of this book as an infinite Excel file: each sheet includes all transactions during a specific time interval (10 minutes, for example), and each row is a unique exchange. In that row, it is clear who sent what, to whom, for what, and for how much money.

How it works?

But what is fascinating about this book is not only its content but how it works:

- It’s shared: Every community member has an exact book copy. When someone adds a new page (with new transactions), all copies are updated simultaneously, ensuring everyone is in sync.

- It’s safe: Once a page is written, no one can erase or modify it. To do so, you would have to simultaneously change all copies of the book scattered around the world… without anyone noticing—a virtually impossible trick.

- It is decentralized: This book does not belong to a single person or company. It is distributed among thousands of computers (called nodes) that work together to keep it running. It is like a global community where all participants are responsible for caring for and protecting the book.

Simply put, the blockchain is the technology that makes it possible to keep this ledger of transactions transparent, secure, and universal. Everyone receives the same real-time update every time someone writes to it, eliminating the need to rely on a single entity to manage the record. Brilliant.

We now know that this digital ledger is none other than the blockchain, the basis of the technological revolution. In this system, each ledger sheet is called a block, and each block contains a set of grouped transactions. These blocks are chained together immutably, forming a chain of blocks or blockchains. From here on, we will use the term blockchain to refer to this innovative ledger.

2. How does a transaction appear in the blockchain ledger?

Each transaction on the blockchain is like a row in a ledger sheet. That row contains all the information needed to record the value exchange between two parties, organized clearly and securely. Let’s break it down.

Visible information (transparent to all)

This part of the transaction is accessible to all network participants, ensuring transparency but without compromising personal privacy:

- Public key of the issuer: It is the source address that indicates who is sending the funds. You can imagine it as a long sequence of characters unique to each member of the network, something like:

“1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa”

Although it is visible to everyone, it is not directly linked to your personal identity.

- Receiver’s public key: This is the destination address that indicates who is receiving the funds. It is similar to the sender’s address: a unique string of characters.

- Amount Transferred: This is the amount being sent. For example, “0.5 bitcoins.”

This visible information is transparent to everyone on the blockchain but is designed not to expose personal data or associate public keys with specific individuals. In this way, a balance between transparency and privacy is achieved.

Protected information (encrypted and private)

In addition to the visible data, each transaction includes encrypted information that ensures its authenticity and prevents manipulation.

- Issuer’s digital signature: Consider it a unique seal that certifies the transaction’s validity. This signature is generated using a private key (the issuer’s secret password) and confirms that the rightful owner of the funds has authorized the transaction. Although the signature ensures the transaction’s validity, it does not reveal how it was generated or compromise the issuer’s security.

- Additional details (on some blockchains): In more advanced blockchains, such as Ethereum, transactions record money exchanges and include elements such as smart contracts.

- A smart contract is a computer program that runs automatically when certain predefined conditions are met. For example, a contract can release a payment only when a product is delivered.

- All information related to the contract is also encrypted and, in many cases, may result in a transaction once the contract is settled.

Each row of the blockchain blends transparency and security: visible data ensures the system’s transparency. At the same time, encrypted elements protect privacy and ensure only authorized persons can interact with the funds. This innovative design makes the blockchain a reliable and robust system, suitable for managing everything from financial transactions to automated agreements.

3. Cryptography and information encryption

Imagine that each participant in the blockchain network has a personal cash box. This box is special because it has two unique keys:

- A key to open the box (private key). The private key is like the key to the lock: only you can use it to access the box’s contents.

- Another key is to give the box address to others (public key). The public key is like a postal address: anyone can use it to send you something (in this case, funds).

How do you ensure that only you can use your key and that no one else can open your box? This is where cryptography comes into play.

What is cryptography?

Cryptography is like the secret language of mathematics. It protects information by making it undecipherable to anyone without the right keys. In blockchain, cryptography is used for two fundamental things:

- Encrypt private information in transactions: Converting data into an unreadable format without the correct key.

- Create digital signatures: Guarantee that a transaction is authentic and has not been manipulated.

The magic of prime numbers

The cryptography we use in the blockchain is based on something that seems simple but compelling: prime numbers. A prime number is like an indivisible brick in mathematics: it can only be divided by 1 and itself.

Now imagine taking two gigantic prime numbers (hundreds of digits long) and multiplying them to get an even more significant number. It is easy to multiply them, and anyone can do it. However, it is tough to break them down to find the original primes. This would be like finding a needle in a haystack the planet’s size!

At the heart of blockchain security is cryptography based on prime numbers. The private and public keys are mathematically linked. Here’s how it works:

- Your private key is a secret number generated by very complex mathematical calculations.

- Your public key is created from this private key, but in a virtually impossible way to reverse. Multiplying two large prime numbers to make your public key is easy. But if someone were to try to deduce your private key from your public key, they would need to solve a mathematical problem so complicated that it would require thousands of years, even with the most powerful computers.

- Your private key is used to sign the transaction: When you digitally sign a transaction, you use your private key to create a unique “code” based on prime numbers. This code acts as your personal seal, proving that you, and only you, have authorized the transaction.

- The blockchain network nodes use your public key to verify your digital signature. This process ensures that the transaction is legitimate without revealing your private key.

Public and private keys

Returning to the analogy of the cash box, let’s assume that the cash box is locked with a very special padlock:

- You use your private key to open or close the box in a unique way that only you can do.

- Anyone can use your public key to verify that you opened or closed the box, but they cannot use it to open or change anything inside.

This procedure is brilliant because it provides two essential properties:

- Absolute security: Your funds are protected by the arithmetic of prime numbers.

- Guaranteed privacy: No one can deduce your private key from your public key.

4. How are transactions consolidated in a blockchain block?

Remember that the blockchain is like a giant ledger, where each sheet (block) contains a set of transactions. However, these transactions are not added automatically; they must first go through a verification and consolidation process to ensure they are authentic and permanent. This process has three main stages.

Grouping of transactions in time blocks

When someone submits a transaction, it is not immediately recorded on the blockchain. Instead, it follows these initial steps:

- The transaction travels through the network: Once digitally signed by the sender, the transaction is broadcast to all nodes in the system. Nodes are like distributed verifiers that check the validity of transactions before including them in a block.

- Verifications performed by the nodes: Each node performs two key checks.

- Validity of the digital signature: The issuer’s public key allows the node to verify that the digital signature was indeed generated with the corresponding private key but without the need to know this private key.

- Sufficiency of funds: Each node has a complete copy of the transaction ledger, which can track all the sender’s previous transactions to calculate its current balance. The transaction is automatically rejected if the sender attempts to send more than it has.

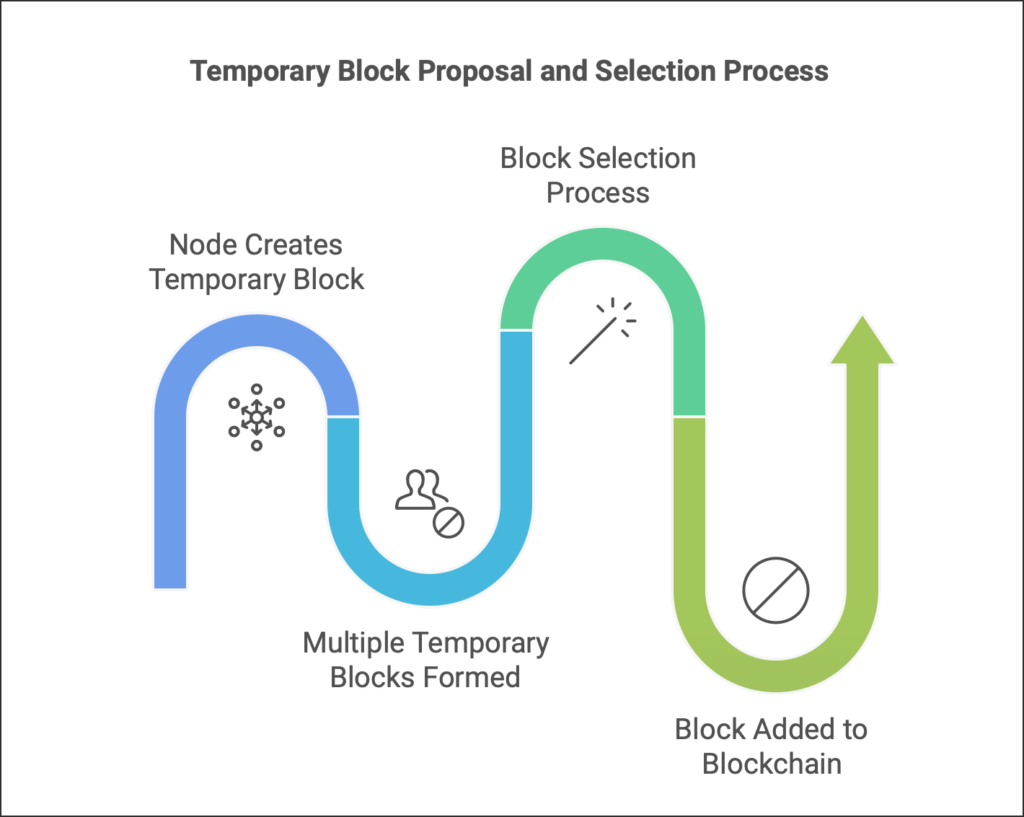

Once the transactions pass these checks, they are placed in a temporary block, like a page ready to be added to the ledger, awaiting final consolidation.

Each verifier node builds its time block, meaning that not all nodes initially have the same time block. This happens for several reasons:

- Differences in the order in which transactions are received: Transactions arrive at nodes at slightly different times due to network latency. For example, Node A may receive Transaction 1 and then Transaction 2, while Node B gets them in the reverse order.

- Criteria for including transactions in the block: As explained later, each node can prioritize including certain transactions over others.

Temporary blocks are proposals from each node to form the next block on the blockchain. However, only one of these blocks will be chosen to be definitively added to the chain.

How is a single final block selected?

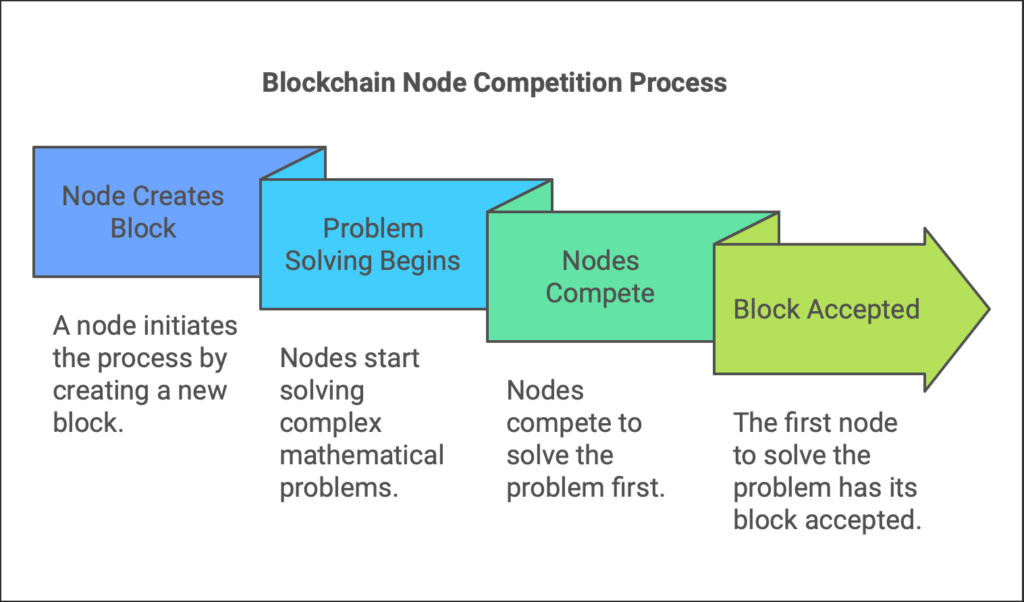

The process of selecting a single block to be added to the blockchain is called mining. Although the term conjures up images of miners extracting gold, here it refers to the computational work that ensures that only a valid block joins the chain.

Imagine that each node with a temporary block competes to have its block accepted as the next block on the blockchain. To win this competition, the node must solve an extremely complex mathematical problem in competition with all other nodes.

It is like trying to open a digital safe by pushing millions of combinations per second until the only one that unlocks access is found. Once a node finds the solution, it announces it to the entire network, and the other nodes quickly verify that the solution is correct.

The first node to solve the problem “mines” the block and adds it to the blockchain. This node, as a reward for its effort, receives two payments:

- The block reward: A fixed amount of the blockchain cryptocurrency (e.g., bitcoins). This amount decreases over time (it is halved every four years in an event called halving).

- Transaction fees: Each transaction in the block includes a small fee that the issuer pays the miners to incentivize the validation of their transaction. Not all fees are equal, and verifier nodes prioritize transactions with higher fees when generating their temporary blocks with new transactions.

Mining

The term mining is used as an analogy to gold mining. Gold miners dig through tons of earth to find small amounts of gold. In the blockchain, nodes perform millions of calculations to solve the mathematical problem and earn their reward, as if extracting “digital gold.”

The mining process can be likened to a thrilling relay race, where each runner (node) competes to carry the baton (the block) to the finish line (the blockchain). Each node races to solve a complex mathematical puzzle, testing combinations at lightning speed, to secure their place on the chain and earn the coveted cryptocurrency reward.

The first runner to solve the puzzle reaches the finish line, adds the block to the chain, and claims the prize (reward + commissions). The remaining runners acknowledge the result and gear up for the next race—the competition for the next block.

5. Types of mining

There are several mechanisms for determining which node has the right to add its temporary block to the blockchain. These are the most common ones:

Proof of Work (PoW)

This is the best-known method used by blockchains such as Bitcoin. Miners must solve a mathematical problem through trial and error. It is secure and decentralized but consumes a lot of energy because it requires much computational power. Solving the problem is like looking up a number that, combined with the information in the block, generates a hash or unique code that meets specific requirements (for example, it must start with a series of zeros).

Proof of Stake (Proof of Stake, PoS)

This method is based on the amount of cryptocurrency a node holds, rather than its computational power. The more cryptocurrency a node has “staked,” the higher the likelihood it will be chosen to validate and add its temporary block. It is more energy-efficient than proof-of-work, which does not require large computational power. Additionally, it significantly reduces the environmental impact associated with mining. To understand it, imagine a lottery where the chances of winning increase with the number of tickets you hold.

Other more recent methods

- Proof of Space and Time: Uses disk space instead of computational power, as does the Chia cryptocurrency.

- Proof of Authority: Relies on a small group of pre-validated nodes to aggregate blocks, ideal for private blockchains.

The average time to mine a block on blockchains such as Bitcoin is approximately 10 minutes. This interval ensures the network’s stability by adjusting the mathematical problem’s difficulty as the miners’ total computational power changes. In other networks, such as Ethereum, the time to mine a block can be significantly less, around 12-15 seconds, optimizing the system for applications that require higher speed.

In short, mining is a competitive process that ensures that only valid blocks are added to the blockchain while maintaining the security and decentralization of the system. The different mining methods seek to balance efficiency, sustainability, and security, adapting to the needs of each blockchain.

Blockchain applications beyond cryptocurrencies

The blockchain began as the secret gear that powered cryptocurrencies. Still, its potential extends as a web of possibilities that promises to revolutionize how we live, work, and relate to the digital world. This technology is transforming key sectors of society by offering a secure, transparent, and decentralized way of recording information.

Every ‘bureaucratic’ transaction in this ecosystem, such as registering a birth, the beginning or end of a partnership, or a university degree, would function like an ‘economic’ transaction on the blockchain.

Let’s explore some of their current and future applications and how they can impact your life.

Digital identity and privacy

Imagine a world where your digital identity is entirely controlled and protected, like a treasure chest you can only open with your private keys. With the blockchain, you can store key information, such as your ID card, academic degrees, or professional certifications, in a secure, accessible, decentralized system.

For example:

- College degrees: Universities could issue your academic achievements as immutable digital records on the blockchain. When you need to prove your education, you could share an encrypted link that allows you to verify its authenticity without intermediaries.

- Professional certifications: Similarly, a certification company could register your achievements or skills on the blockchain. This would allow future employers to verify your experience immediately, reducing the time and complexity of selection processes…

- Simplified verification: Administrations or companies may confirm specific data, such as your age, marital status, or accreditations, without disclosing additional information.

In all these cases, the blockchain guarantees security, privacy, and instant verification, eliminating the need for complicated processes or unnecessary intermediaries, avoiding fraud or data leakage risks, and protecting your privacy.

2. Supply chains

The magic of blockchain also shines in supply chains, transforming them into traceable maps where every step of a product’s journey is recorded, like a detective following the traces of the origin. This is especially useful in sectors such as:

- Food: The blockchain allows you to track every food step, from its origin to your table. For example, you could scan a QR code on a package of fruit and know where it was grown, when it was harvested, and how it was transported, ensuring it meets quality and sustainability standards.

- Fashion: Brands can use blockchain to demonstrate transparency in their production processes. You could verify that a garment was manufactured under ethical conditions, with sustainable materials, without exploiting workers, and track every stage of the process from fiber production to store distribution.

- Electronics and product warranties: The blockchain can guarantee that the components of your technological devices, such as smartphones or computers, come from certified suppliers and improve warranty management. Each product could include a record on the blockchain detailing its origin, production conditions, and warranty terms. For example, if your computer develops a fault, the blockchain could automatically verify if it is within the warranty period and facilitate the claim process without paperwork or intermediaries.

Electronic voting

Imagine a future where voting is as simple and secure as sending a message, with every vote sealed on the blockchain to ensure crystal-clear, tamper-free elections.

- Each vote is recorded as a transaction on the blockchain, ensuring it cannot be altered or manipulated. This works because each transaction includes an immutable record that guarantees the authenticity of the vote and protects the voter’s identity, maintaining the privacy of their choice.

- The results would be auditable in real-time by any citizen, as each vote is recorded in a decentralized network accessible to all. This ensures total process transparency and eliminates suspicions of fraud, as the records cannot be altered once cast.

4. Smart contracts

A smart contract is a record on the blockchain containing software code that is automatically executed when certain conditions are met. The result of the contract resolution can be a new transaction on the blockchain. The possibilities are endless:

- Real estate: The blockchain could completely transform the market, eliminating the need for notaries and official land registries. Imagine a system where properties and sales contracts are registered in a specific blockchain. When both parties fulfill the conditions agreed upon in a smart contract (such as full-price payment), the change of ownership is automatically, securely, and verifiably registered. This system saves time and associated costs, minimizes fraud risks, and ensures transaction transparency.

- Insurance: Smart contracts can revolutionize the insurance industry by automating compensation payments. For example, in the event of a flight delay, a smart contract could connect to airline databases to verify the delay. Once confirmed, the system would automatically release the payment to the insured without manually claiming or waiting for additional approvals. This not only reduces waiting time but also ensures transparency in the processes.

- Logistics: In shipment management, smart contracts could automate payments to carriers and suppliers when agreed conditions are met. For example, a smart contract could be linked to the shipment tracking system. When the package arrives at its destination, and a digital scan confirms the receipt, payment will be released automatically. This eliminates disputes, reduces administrative costs, and ensures that all parties fulfill their obligations efficiently.

5. Art and entertainment: NFTs

An NFT (non-fungible token) is a unique digital asset representing the ownership or authenticity of a unique object on the blockchain. Unlike exchangeable cryptocurrencies with the same value (such as a 10-euro bill), an NFT is unique and cannot be replaced by another. This makes it a powerful tool to certify the originality of digital or even physical assets. For example:

- Digital art: Artists can create digital works and sell them as NFTs, guaranteeing that each buyer owns an original, registered copy on the blockchain.

- Music and entertainment: Musicians can release exclusive songs as NFTs, ensuring direct royalties and eliminating intermediaries. This also applies to event tickets, allowing transparent control of resale.

- Video games: Unique in-game items, such as weapons, costumes, or special characters, can be bought, sold, and tracked as NFTs.

6. Decentralized Finance (DeFi)

The blockchain is also transforming the financial world beyond cryptocurrencies. Some examples of its impact are:

- p2p lending: Decentralized finance platforms (DeFi) allow people to lend and borrow money directly from each other through smart contracts. These contracts eliminate the need for banks or intermediaries, automating granting and repaying loans. For example, a borrower could offer digital collateral (such as cryptocurrencies) to obtain a loan, while the lender receives interest automatically thanks to the smart contract.

- International payments: The blockchain allows for almost instantaneous money transfers with minimal costs, eliminating the need for banks or traditional payment networks. This is especially useful for migrant workers sending remittances to their families, as it avoids the high fees of services such as Western Union or bank transfers. In addition, the transaction is fully transparent and traceable on the network.

- Stablecoins: Stablecoins are cryptocurrencies linked to stable assets such as the dollar, euro, or even precious metals, making them ideal for everyday transactions by eliminating the volatility of traditional cryptocurrencies such as Bitcoin. For example, a merchant could accept payments in stablecoins without worrying about abrupt fluctuations in their value. At the same time, users use them to save or make international payments with more excellent stability.

- Blockchain-based stock market: In a decentralized system, company shares could be issued and traded directly on the blockchain. This would eliminate the need for intermediaries such as traditional stock exchanges, allowing instant transactions, greater transparency, and reduced operating costs. In addition, it could facilitate the participation of global investors without the current barriers.

7. Health

In the healthcare sector, blockchain transforms how data and resources are managed, offering secure, transparent, and efficient solutions to complex problems.

- Medical records: Patients could store their medical records in a decentralized and secure way, granting access only to the professionals they choose. This would reduce errors and duplication and facilitate medical care worldwide.

- Organ donations: The blockchain could guarantee transparency and fairness in transplant waiting lists, avoiding manipulations and ensuring that organs reach the right patients quickly.

- Vaccine distribution: By tracking each dose from manufacture to application, the blockchain can prevent vaccine diversion, ensure they reach the right regions, and combat counterfeiting.

- Telemedicine and digital prescriptions: Electronic prescriptions could be registered in the blockchain, allowing immediate verification and preventing fraud. In addition, in telemedicine consultations, records could guarantee the confidentiality and validity of medical recommendations.

8. Energy and environment

The blockchain is also helping to create more sustainable and efficient energy systems, facilitating the transition to a more decentralized and cleaner model. Some key applications include:

- p2p energy: Allowing users to buy and sell renewable energy directly from each other, without intermediaries. For example, if you have solar panels, you could sell surplus energy to your neighbor in an automated and transparent way through smart contracts.

- Green certificates: Track the provenance of energy to ensure that it comes from renewable sources. This helps companies and consumers ensure that they are meeting their environmental commitments.

- Measurement and certification of energy generated or consumed: Smart meters connected to each facility or home automatically record the energy generated or consumed. This data is added to the blockchain, guaranteeing its accuracy and immutability.

The Universe of blockchain and cryptocurrencies: present and future

The world of cryptocurrencies and blockchain technology has evolved at a dizzying pace, transforming the financial landscape and various sectors of society. Below, we explore the current state of the market, institutional support, current regulation, prospects, and recommended resources to delve deeper into this fascinating universe.

The current state of the cryptocurrency market

In 2024, the cryptocurrency market has experienced remarkable growth, establishing itself as an asset class of interest to retail and institutional investors. According to recent data, more than 18,000 cryptocurrencies are in circulation, reflecting the diversity and expansion of the crypto ecosystem.

Security in cryptocurrency investments has improved by implementing stricter regulations and developing more robust investment platforms. However, prudence among investors informed decision-making, and recognized investment platforms are essential to mitigate volatility and potential fraud risks.

The approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) has been a significant milestone in 2024. These funds have attracted a considerable influx of capital, surpassing $100 billion in assets under management.

The inflow of capital into these ETFs, together with the revaluation of bitcoin in recent months, has boosted the assets of these vehicles. Analysts expect the cryptocurrency to continue to receive support in the coming months, especially after several firms have expressed their commitment to acquire a significant amount of bitcoins in the medium term.

This development has facilitated institutional and retail investors’ access to the cryptocurrency market, contributing to the maturation and stability of the sector.

Institutional support and regulation

The institutional adoption of blockchain and cryptocurrencies has advanced significantly. In Europe, the entry into force of the MiCA (Markets in Crypto Assets) Regulation on December 30, 2024, establishes a uniform legal framework for cryptoassets, offering more excellent guarantees for consumers and operator requirements.

In Spain, financial institutions such as BBVA and Banco Santander have shown interest in offering services related to crypto assets under this new regulatory framework. However, the National Securities Market Commission (CNMV) warns about the significant risks of investing in crypto assets, recalling that, despite the regulation, these assets remain highly volatile and speculative.

In addition, as of January 2024, it is mandatory to declare cryptocurrencies and other virtual currencies in Spain, according to Royal Decree 249/2023, which introduces regulatory amendments to implement changes made by Law 11/2021 on measures to prevent and combat tax fraud.

Future of blockchain and cryptocurrencies

The horizon for blockchain and cryptocurrencies looks promising. Further integration of blockchain technology is anticipated in sectors such as decentralized finance (DeFi), supply chain, healthcare, and energy. The tokenization of financial assets and the possible issuance of digital currencies by central banks could redefine the traditional financial system.

However, the future also presents challenges, especially regarding regulation and security. International coordination in regulating crypto assets will be crucial to avoid regulatory arbitrage and ensure investor protection.

Final conclusions

Blockchain and cryptocurrencies represent much more than emerging technologies; they are a silent revolution transforming how we interact with the digital world. They have opened the doors to a future where trust will no longer depend on centralized institutions but on the transparency of codes and blockchains that cannot be manipulated.

From its humble beginnings as a radical idea to redefine money to becoming the driver of innovations ranging from digital identity to asset tokenization, the blockchain has demonstrated its ability to profoundly impact social and economic structures. While the path has been fraught with uncertainty, fraud, and volatility, it has also generated unprecedented opportunities to build a more inclusive, transparent, and decentralized world.

The future of blockchain and cryptocurrencies will depend on our ability to balance innovation with responsibility. Clear regulations, massive education, and global collaboration will be the keys to unlocking their full potential. The opportunities are immense, and the power of this technology is just beginning to unfold. Now, the challenge is in our hands: to build a future worthy of this revolution.

The blockchain is not just a tool but a new language for building trust in a world that needs it more than ever. The history that begins to be written today in blockchain will be remembered as the foundation of a new digital era… From its beginnings as a fringe concept to becoming a central component of global financial and technological discourse, its evolution continues to shape the future. Understanding and adapting to these changes will be essential to navigating an increasingly digitized and decentralized world.

References for further information

Books

- “The Bitcoin Standard: The Decentralized Alternative to Central Banking“

by Saifedean Ammous: This book explores the history of money and how Bitcoin provides a decentralized alternative to the traditional banking system. Perfect for those looking to understand the economic background of cryptocurrencies.

- “Mastering Bitcoin: Unlocking Digital Cryptocurrencies“ by Andreas M. Antonopoulos: A comprehensive technical guide on how Bitcoin works. Perfect for developers and enthusiasts looking to dive deeper into the practical and technological aspects.

- “Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher: Explains blockchain in a simple and structured manner, making this complex technology accessible to beginners.

- “The Infinite Machine: How an Army of Crypto-hackers Is Building the Next Internet with Ethereum“ by Camila Russo: A fascinating account of the creation of Ethereum, perfect for those seeking inspiring stories from the crypto world.

These books can be found on Amazon in their paper version, in their version for Kindle version, or as an audiobook for a subscription to Audible.

The links above are affiliate links, meaning if you decide to purchase them, the blog will receive a small commission at no additional cost. This partnership helps keep the content free, informative, and quality.

Online articles

- Crypto’s Legacy Is Finally Clear

This article from The Atlantic reflects on how cryptocurrencies have influenced culture and politics, highlighting their impact beyond the technological realm.

- As bitcoin breaches $100k, bankers who quit trading for crypto feel vindicated.

Published in Financial News London, this article discusses how Bitcoin’s breach of $100,000 has validated the decisions of financial professionals who migrated to the crypto sector.

- Crypto regulation needs a thoughtful rethink under Trump

This Financial Times article discusses the need to rethink cryptocurrency regulation under the Trump administration, emphasizing the importance of transparent and predictable policies.

- The rise and fall of cryptocurrencies: defining the economic and social values of blockchain technologies

This study published in Financial Innovation examines blockchain technologies and their role in the Metaverse, analyzing how to invest in cryptocurrencies and strategies for buying and trading them.

Videos on YouTube

Legal Notice

The content of this article is purely informative and purely informative and educational. It does not constitute financial, tax, or legal advice. Before you make any investment decision, we recommend you consult a qualified professional who can look at your personal and economic situation. Investments involve risks; the investor is responsible for analyzing and assuming those risks.