A practical guide for rational and conscious investment

“Never invest in a business you can’t understand.”– Warren Buffett, famous American investor and entrepreneur.

The story of the old fisherman

In a small coastal village, there lived an old fisherman known as much for his skill with the nets as for his patience and serenity forged after years of living with the sea. Every morning, at the first light of dawn, the fisherman would set out in his modest boat, cast his nets out to sea, and return mid-morning with a generous load of fish. His routine seemed simple, but it was guided by experience and wisdom, which fascinated everyone in the village.

Two young men from the village, restless and ambitious, had been watching the fisherman for days. Intrigued by his life’s apparent simplicity, they approached him one morning just as the man returned from his fishing trip.

– “Sir, we’ve been watching your fishing prowess for some time, and every day, you come back with a good assortment of fish, and we don’t understand anything. Why haven’t you bought a bigger boat and hired a crew all the years you’ve been out fishing? Then you could have caught more fish and made much more money.”

As he manipulated the nets with his hands still wet and tanned by the salt, the old fisherman observed them serenely as if he knew the answer before the question was asked.

– “And after that, what would I have done next?” -he asked in a voice that seemed to come from the depths of the sea.

The young men, surprised by his response, looked at each other before one of them responded, almost impatiently:

– “Well, with the money, you could have bought more ships, hired employees, and set up a big company – you would have been a successful entrepreneur!”

The fisherman nodded slowly as if giving space for the boys’ words to settle in. Then, just as calmly, he insisted:

– “And once I achieved that, what would I have done next?”

– “Then you could retire quietly, enjoy life without worries, travel if you want to, spend time with your family, and do what you like best,” – answered the second young man, already convinced he had the correct answer.

The fisherman drew a slight smile on his face and, looking at them with the confidence that only experience can give, he answered:

– “And what do you think I’ve been doing all these years?”

The young people remained silent, with a sense of bewilderment. They had sought to teach the fisherman something about ambition and success. Still, he had revealed to them a profound truth: life is not about accumulating more and more goods and riches but about understanding what we want and need to be happy.

Why and for what purpose do we invest?

The story of the old fisherman is not only a tale of simplicity but a powerful lesson about conscious choices. Often, we find ourselves caught in a never-ending race governed by unbridled ambition: more money, more possessions, more success. But, as the fisherman demonstrates, the true purpose of our actions should align with our deepest aspirations: peace of mind, freedom, security, or, perhaps, the time to do what we love.

This exact reflection should guide our investment decisions. Before considering where to invest our savings, we should ask ourselves why and what we want to do it for. What is our goal? Do we want to save for a peaceful retirement? Buy a home? Undertake a personal project? Achieve the financial independence that will allow us to enjoy the present. Like the old fisherman, we must first define what “enjoying life” means.

There is no universally best investment strategy. The best strategy for our purposes is what does exist, which will depend on our aspirations, financial situation, and risk profile. A person seeking to build long-term wealth will make very different decisions than someone who needs to make a return on their savings in the short term.

Therefore, defining our life objectives is the first essential step before investing. Once we know what we want to achieve and why, we can choose those alternatives that fit our goals. Investment, in the end, is not an end in itself but a vehicle to achieve that which brings us closer to a fuller life aligned with our dreams.

Books about rational investment

For those who wish to delve deeper into the practice of rational and conscious investing, we have selected some key books that we consider essential. Each book is carefully chosen for its relevance and clarity in explaining the fundamentals of investing. The links we share below are affiliate links, meaning that if you decide to purchase them, the blog will receive a small commission at no additional cost. This partnership helps us keep the content free, informative, and high-quality. We hope you find these resources as helpful as they have been for thousands of investors!

- “The Intelligent Investor” by Benjamin Graham.

- “Rich Dad, Poor Dad” by Robert Kiyosaki: classic book on real estate investing and financial freedom.

- “One Step Ahead of Wall Street” by Peter Lynch (for active funds).

- “Los trucos de los ricos 3” by Juan Haro.

- “The Psychology of Money” by Morgan Housel (reflections on financial decisions and how to think like an investor).

These books can be found on Amazon in their paper version, in their version for Kindle version, or as an audiobook for a subscription to Audible.

How do you evaluate an investment?

When deciding where to invest our savings, having a clear and structured view of the options is essential. This article will explore several investment strategies that suit different profiles and financial objectives.

Each alternative will be presented practically and analyzed using key criteria. These criteria will allow us to evaluate and compare the options objectively, helping you identify the most suitable based on your aspirations, risk tolerance, and time horizon. Below, we break down each of these criteria so that you can apply them to your investment decisions in an informed and effective manner:

- Expected return: What annual or cumulative percentage return does the investment offer?

- Associated risk: What is the volatility or probability of loss?

- Investment term: Is it short-term (1 year), medium-term (1-5 years), or long-term (more than 5 years)?

- Liquidity: How easily can you recover your money if you need it? Some investments, such as real estate, are less liquid than others.

- Costs and fees: What management, transaction, or maintenance fees apply? It is essential to maintain profitability.

- Taxation: What taxes affect the profits obtained? Evaluate whether there are tax advantages or penalties.

- Level of effort or management required: Is it a passive investment, such as index funds, or does it require active monitoring, such as individual stocks or startups?

- Diversification: Does it allow you to diversify risk or complement your current portfolio?

- Alignment with your life goals: Does it fit your financial needs, lifestyle, and short-, medium- and long-term goals?

- Inflation: Is investment protected, or is it negatively affected by inflation?

- Reputation and stability of the asset: What support or confidence does the investment offer, such as the solvency of the management company or historical soundness?

What are the main investment alternatives?

Once the evaluation criteria have been established, it is time to put them into practice. Each investment alternative offers a range of opportunities but also poses unique challenges. The key is to analyze these options through the lens of our objectives and the factors we have defined. We can identify which best suits our needs and aspirations by comparing each strategy using these criteria.

Here is a list of diversified investment options to suit different risk profiles, time horizons, and life objectives:

- Fixed-term deposits: Guaranteed security and fixed returns in the short and medium term.

- Index funds and ETFs: Low-cost alternatives that replicate the performance of stock market indexes.

- Individual shares: Investment in listed companies to obtain returns through dividends or stock appreciation.

- Active investment funds: Professional management to obtain returns in specific markets.

- Real estate for rental or appreciation: Purchase real estate to obtain passive income or sell at a higher price.

- Government and corporate bonds: Fixed income instruments with periodic payments and return at maturity.

- Cryptocurrencies and digital assets: Alternative assets with high risk and volatility, but with potential for high returns.

- Commodities (gold, silver, oil): Inflation protection and risk diversification.

- Pension plans: Long-term savings vehicles with tax benefits.

- Crowdlending or P2P lending: Financing of individuals or companies in exchange for attractive interest rates.

- Startups and venture capital: Investments in emerging companies with high growth and risk potential.

- Savings insurance or Unit Linked: Hybrid products combine investment and personal protection.

Which investments suit me best?

This section will analyze and compare various investment alternatives using the previously defined criteria. We want you to know that our objective is to provide you with clear, objective, and structured information so that you can identify the options that are best aligned with your objectives and investor profile.

It is important to note that we are not financial advisors and do not offer personalized recommendations. The information presented here is purely informative and educational. Each investor should conduct their analysis and, if necessary, consult with a financial professional before making decisions. Investing knowledgeably and consciously will allow you to build a strategy tailored to your aspirations and risk tolerance. This article will show you what questions to ask yourself but cannot be answered because your ambitions, risk aversion, and life and family context decisively condition those answers.

Country-dependent data are provided in this article for the case of Spain. The reader should find the relevant data in their country of origin.

1. Time deposits

Strengths

- Associated risk: Fixed-term deposits are considered one of the safest investments since the invested capital is protected by the Deposit Guarantee Fund of up to 100,000 euros per holder and entity in Spain.

- Investment term: They offer flexibility in terms, which can vary from 3 months to several years, allowing investors to choose according to their needs.

- Costs and commissions: Generally, there are no opening or maintenance commissions, which makes it easier to know the net profitability in advance.

- Reputation and stability of the asset: These products are offered by regulated financial institutions, which provides confidence and stability to the investor.

Weaknesses

- Expected return: Although they offer a fixed and known profitability in advance, rates are usually moderate. Currently, some entities in Spain offer fixed-term deposits with yields of around 3% APR for terms of 12 months.

- Liquidity: The money remains immobilized for the agreed term. Although some deposits allow early cancellations, they usually involve penalties that affect profitability.

Opportunities

- Inflation protection: In low-inflation environments, time deposits can preserve the purchasing power of capital, although their ability to generate positive absolute returns is limited.

- Diversification: They can complement an investment portfolio, providing stability and security when combined with assets of higher risk and profitability.

Risks

- Inflation: If inflation exceeds the return on the deposit, the investor may experience a loss of purchasing power.

- Interest rate: New deposit contracts, such as the current one, could offer lower yields than historical ones in decreasing interest rates.

Specific data

- Historical yield: In December 2024, some entities in Spain offered fixed-term deposits with around 3% APR for 12-month terms.

- Current trend: With the recent reduction of interest rates by the European Central Bank to 3%, a decrease in yields offered on time deposits is anticipated shortly.

Summary

In summary, time deposits are a safe and predictable investment option, suitable for conservative profiles prioritizing capital protection. However, their limited profitability and possible erosion due to inflation are factors to consider when integrating them into a diversified financial strategy.

Sources

- HelpMyCash – Bank Deposits

- HelpMyCash – How to choose the term of a deposit

- HelpMyCash – Most profitable Spanish Deposits

- CincoDías – Interest rate cuts in Europe

- El País – Options for conservative savings

2. Index funds and ETFs

Strengths

- Expected return: Index funds and ETFs have historically offered attractive returns when replicating market indices. For example, the Invesco Technology S&P US Select Sector UCITS ETF has posted a cumulative return of 676.36% over the past ten years.

- Costs and fees: These products typically have lower fees than actively managed funds, which can improve net returns for the investor.

- Diversification: They allow access to a wide range of assets and sectors, facilitating portfolio diversification with a single investment.

Weaknesses

- Taxation: In Spain, ETFs do not enjoy the tax advantage of transfers between funds without a tax toll, which may generate tax liabilities when making portfolio changes.

- Level of effort or management required: Although passive management instruments, they require periodic monitoring to adjust the portfolio according to financial objectives and market conditions.

Opportunities

- Accessibility: The growing offer of index funds and ETFs in the Spanish market makes it easier for investors to access these products.

- Transparency: By replicating well-known indices, they clarify underlying investments and their performance.

Risks

- Market risk: As they are index-linked, their performance is subject to market fluctuations, which may imply losses in periods of volatility.

- Limited supply of index funds: Although it has improved, the availability of index funds in Spain is still more limited compared to other markets.

Specific data

- Historical returns: Some index funds and ETFs have shown significant returns over the past decade. For example, the Invesco Technology S&P US Select Sector UCITS ETF has achieved a cumulative return of 676.36% over ten years.

- Fees: Management fees for ETFs typically range from 0.10% to 0.30% per annum, while those for index funds can range from 0.15% to 1%.

Summary

In summary, index funds and ETFs are efficient, low-cost investment tools that give investors access to broad diversification and potentially attractive returns. However, it is essential to consider aspects such as taxation, market risk, and the need for periodic monitoring when incorporating them into an investment strategy.

Sources

1. Rankia – Index funds vs ETFs: which is better?

2. Carlos Galán – Index funds or ETFs: which is better?

3. The Investment Club – ETFs vs. Index Funds: Full Comparison

4. Hola Inversión – Index Funds vs ETFs: Differences and Taxation

5. Rankia – The best index funds to invest in Spain

6. CincoDías – The rate cut reaches passive management

7. CincoDías – The markets head towards the end of the year with a full year of profitability.

3. Individual actions

Strengths

- Expected return: Historically, the stock market has offered an average return of 6% to 10% per year over the long term, depending on the index and sector. For example, the S&P 500 has generated an average annual return of 10.5% since 1926.

- Liquidity: Individual shares are highly liquid assets that can be easily bought and sold in the stock markets during trading sessions.

- Potential diversification: The portfolio can be diversified by investing in stocks of different companies or sectors.

- Reputation and asset stability: Investing in solid companies with a track record can offer stability and reduce risk. Companies such as Apple, Microsoft, and Coca-Cola are examples of stable investments.

Weaknesses

- Associated risk: Volatility is a key characteristic of individual stocks. The probability of capital loss is high in the short term if the company does not meet expectations. For example, in 2022, technology stocks fell as much as 30% due to rising rates.

- Level of management required: Requires constant analysis and active monitoring of companies and sectors, which requires time and knowledge.

- Costs and commissions: Although commissions have decreased with platforms like eToro or Interactive Brokers, there may be hidden currency changes or spreads costs.

Opportunities

- Accessing growth companies and innovative sectors such as technology, artificial intelligence, and renewable energy can offer extraordinary returns. For example, Tesla shares rose 740% in 2020.

- Opportunity to invest in global and emerging companies with high appreciation potential.

Risks

- Inflation: Although stocks historically protect against inflation, prolonged periods of recession can affect their performance.

- Specific risk: Individual stocks have a particular risk associated with the company’s performance. For example, the bankruptcy of Lehman Brothers in 2008 left investors with no return.

- Taxation: Profits are subject to capital gains tax, depending on local legislation (in Spain, between 19% and 26%).

Specific data

- The average rental yield in Spain is 6.7%(Idealista, 2024).

- The average annual revaluation of housing prices in Spain has been 3.5% in the last 10 years(INE).

- The initial costs, including taxes and management fees, range from 8%-12% of the property’s value.

Summary

Individual stocks attract investors willing to take risks in exchange for high return potential. They require dedication, knowledge, and a long time horizon to mitigate volatility.

Sources

1. Investopedia – Historical Performance of the S&P 500

2. Yahoo Finance – Analysis of high-growth stocks

3. CincoDías – IBEX 35 companies with high dividend yields

4. El Economista – How to invest in individual stocks

5. Morningstar – Equity Risk Management

4. Active investment funds

Strengths

- Expected returns: Active funds have the potential to outperform stock indices. For example, managers such as Peter Lynch achieved annual returns of over 29% during his management of Fidelity’s Magellan fund (1977-1990).

- Diversification: Investing in an active fund allows risk diversification, as the manager selects assets from different sectors and regions, balancing the portfolio.

- Professional management: The experience and analysis of a specialized manager reduces the workload for the individual investor.

- Alignment with life goals: Funds are adapted to different risk profiles and time horizons, from conservative to high-growth funds.

Weaknesses

- Costs and fees: Active funds typically have higher management fees (between 1% and 2.5% per annum), plus potential success fees, which can significantly reduce net returns.

- Associated risk: Although professionally managed, active funds are not guaranteed to outperform the market. According to S&P Dow Jones Indices data, 80% of active funds do not outperform the S&P 500 index over a 10-year horizon.

- Taxation: Profits are taxed as capital gains between 19% and 26% in Spain.

Opportunities

- Investing in active funds allows access to inaccessible sectors or assets, such as emerging markets or specialized niches, where managers can find unique opportunities.

- Active funds adapt the strategy according to the economic cycle, allowing investors to benefit in both bull and bear markets.

Risks

- Investment time horizon: Active funds require a medium to long-term horizon (5-10 years) to maximize the chances of market success.

- Manager dependence: The fund’s performance highly depends on the manager’s skill and decisions, which introduces human risk.

- Inflation: Although they can protect against inflation in bull markets, their performance may not offset the inflationary effect in periods of high volatility.

Specific data

- Average return: Average return between 4% and 6% per annum after fees(Inverco, 2024).

- Fees: Management fees of up to 2% per annum and, in some cases, additional success fees(CNMV).

- Comparative performance: Only 30% of active funds outperform the benchmark over the long term(SPIVA Report, S&P Dow Jones).

Summary

Active mutual funds are an enjoyable alternative for investors seeking to outperform the market and diversify their portfolios without assuming direct management responsibility. However, their high costs and the risk of underperformance versus indexes make them a suitable option only for those with a long-term investment horizon and trust in the managers’ skills.

Sources

1. Morningstar – Historical Performance of Active Funds

2. S&P Dow Jones Indices – SPIVA Scorecard 2023

3. Investopedia – Active vs. index funds

4. El País – How to choose an investment fund

5. Rankia – Best performing active funds

5. Real estate for rent or revaluation

Strengths

- Expected return: Well-located properties can offer a gross rental yield of between 3% and 7% per annum, depending on the market. In addition, the average revaluation of housing in Spain has been 3% per annum over the last 10 years, according to the INE.

- Inflation protection: Real estate tends to preserve the value of money in inflationary times, as rents and property prices tend to rise with inflation.

- Alignment with life goals: It is a tangible investment that offers stability and can be complemented with long-term goals, such as securing passive income for retirement.

Weaknesses

- Liquidity: Real estate has low liquidity, as selling a property can take months or years, especially in saturated markets.

- Active management: Rental investment requires constant management, including tenant search, incident resolution, and property maintenance.

- Costs and commissions: Investing in real estate involves additional expenses:

- Purchase taxes (ITP or VAT, between 6% and 10%).

- Maintenance, repair, and insurance expenses.

- Intermediary and notary commissions.

Opportunities

- Emerging markets: Investing in growing areas benefits you from higher appreciation. For example, cities such as Valencia and Malaga have experienced more than 7% annual growth in housing prices since 2021.

- Vacation and tourist rentals: Platforms like Airbnb have opened up new possibilities for short-term profitability, with higher income than traditional rentals in tourist areas.

Risks

- Associated risk: Profitability depends on the real estate market and may be affected by economic crises, changes in demand, or oversupply. Example: the market downturn during the 2008 crisis.

- Taxation: Rental income is subject to personal income tax in Spain, with rates between 19% and 26% for non-residents and progressive taxation for residents.

- Investment term: It is a medium and long-term investment (5-15 years) since the revaluation of real estate is usually slow and gradual.

Specific data

- Historical Performance: The average return of the S&P 500 has been 10% per year over the past 30 years(Morningstar).

- Dividends: IBEX 35 dividend yield: around 4% per year(Expansión, 2024).

- Transaction costs: Buying and selling commissions between 0.10% and 0.35% per transaction, depending on the broker(DEGIRO, Interactive Brokers).

Summary

Real estate investing is a solid option for those seeking stable passive income and inflation protection, provided they are willing to assume low liquidity and maintenance costs. It is a strategy aligned with conservative, moderate-profile investors with long-term objectives.

Sources

1. Idealista – Rental profitability in Spain

3. Airbnb – Vacation Rental Profitability

4. El País – Areas with the highest real estate revaluation

5. Rankia – Real estate investment and taxation

6. Government and corporate bonds

Strengths

- Relative safety: Government bonds, especially those of countries with high credit ratings (AAA), are considered one of the safest investments.

- Fixed and predictable returns: They offer periodic payments in the form of coupons and the return of the invested capital at maturity.

- Diversification: Adding bonds to a portfolio reduces overall volatility and offsets the risk of other assets, such as equities or cryptocurrencies.

Weaknesses

- Low yield in the current environment: Government bonds typically offer low yields during low interest rates. For example, the German 10-year bond currently provides 2.2% annually (Trading Economics, 2024).

- Inflation risk: Inflation reduces the value of the fixed payments received for the bonds, affecting profitability.

Opportunities

- High-yield corporate bonds: Companies with lower credit ratings (“high-yield” bonds) offer higher yields, e.g., around 6%-8% per annum(Moody’s, 2024).

- Rising interest rate environment: Bonds issued at higher rates are attractive compared to older instruments.

Risks

- Default risk: Low-rated corporate bonds may carry a risk of default, especially in periods of economic recession.

- Duration and rate sensitivity: Bond prices fall if interest rates rise. The longer the duration of the bond, the greater this sensitivity.

Specific data

- Average yield: Developed country government bonds have offered yields between 1% and 3% over the last 5 years(Bloomberg, 2024).

- Corporate bonds: Investment grade bonds offer 3%-5% per annum, while high-yield bonds exceed 6%-8%(Morningstar).

- Average duration: Long-term bonds (10 years or more) have a higher risk of changes in interest rates.

- Default risk: Bonds rated below BBB present a default risk of close to 4% per year in advanced economies(Moody’s, 2024).

Summary

Government bonds are a safe option for conservative investors seeking fixed income and predictability, although they sacrifice returns, especially in high inflation environments. Corporate bonds, on the other hand, offer higher yields but carry additional credit risk. The two decisions depend on the investor’s risk profile, time horizon, and objectives.

Sources

1. Trading Economics – European Government Bond Yields

2. Moody’s – Corporate and Government Bond Ratings

3. Morningstar – Investment grade and high-yield bonds

4. Bloomberg – Global historical bond returns

5. Investopedia – The Impact of Duration and Interest Rates on Bonds

7. Cryptocurrencies and digital assets

Strengths

- Very high potential returns: Cryptocurrencies have proven to offer extraordinary returns. For example, Bitcoin has gone from being worth $1,000 in 2017 to reaching highs near $69,000 in 2021.

- Diversification: Digital assets allow diversifying an investment portfolio, as they have a low correlation behavior with traditional markets.

- Global accessibility: You can invest in cryptocurrencies from anywhere globally, with low entry barriers and no intermediaries.

Weaknesses

- High volatility: Price fluctuations are extreme. Bitcoin, for example, has had drops of over 50% in short periods.

- Uncertain regulation: There are legal risks due to many countries’ need for clear regulations.

- Security: The risks of hacks and losses due to personal errors (e.g., forgetting passwords) are significant.

Opportunities

- Institutional adoption: More and more companies and traditional investment funds are adopting cryptocurrencies as part of their portfolios.

- Technology innovation: Blockchain and other digital assets, such as NFTs and DeFi, revolutionize finance, art, and smart contracts.

Risks

- Adverse regulations: Governments may restrict or prohibit using cryptocurrencies, affecting their price and adoption.

- Competition between cryptocurrencies: Bitcoin and Ethereum dominate, but new technologies may displace existing assets.

- Little protection for investors: In case of losses, there are no guarantees or compensation similar to traditional investments.

Specific data

- Bitcoin‘s cumulative profitability over the last 10 years exceeds 1,000,000%, making it the most profitable cryptocurrency historically.

- Ethereum, the second largest cryptocurrency, grew from $10 in 2017 to highs above $4,800 in 2021.

- The global cryptocurrency market has an approximate market capitalization of $1.2 trillion in 2024, dominated by Bitcoin (45%) and Ethereum (20%).

- Institutional adoption grew significantly: companies such as Tesla and funds such as Grayscale hold cryptocurrency assets.

- Digital assets allow access to DeFi (decentralized finance), with over $40 billion locked up in smart contracts on platforms such as Aave and Uniswap.

Summary

Cryptocurrencies and digital assets are highly volatile and speculative options with a high potential return. They are ideal for investors with a high-risk profile seeking diversification and exposure to new technologies. However, the lack of regulation and associated risks require cautious evaluation before investing.

Sources

1. CoinMarketCap – Capitalization and historical cryptocurrency data

2. Bloomberg – Trends and analysis on digital assets

Glassnode – Blockchain Adoption Statistics and Metrics

4. DeFi Pulse – Decentralized Finance Ecosystem (DeFi)

5. Investopedia – Volatility and risks in cryptocurrencies

8. Raw Materials

Strengths

- Inflation protection: Assets such as gold and silver often act as safe havens of value when there is high inflation or economic uncertainty.

- Diversification: Commodities have a low correlation with other assets, allowing risk diversification in an investment portfolio.

- Constant demand: Resources such as oil, natural gas, and industrial metals are fundamental to the global economy, ensuring long-term relevance.

Weaknesses

- High volatility: Commodity prices fluctuate due to geopolitical, climatic, and supply/demand factors.

- Storage and transportation costs: Physically investing in raw materials, such as metals or oil, entails additional costs that can erode profitability.

- Historical underperformance: Many commodities have underperformed other assets, such as equities, over the long term.

Opportunities

- Energy transition: The rise of renewable energies has increased demand for specific raw materials, such as lithium and copper, for batteries and solar panels.

- Population growth: As the world’s population grows, the demand for food and essential resources also increases.

- Investing in commodity ETFs: Alternatives such as ETFs allow investing in commodities in a more accessible and liquid way.

Risks

- Climatic factors: Droughts, floods, or other extreme weather events can significantly affect the prices of agricultural products.

- Dependence on geopolitics: Tensions between oil-producing or metal-exporting countries can trigger volatility.

- Risk of overproduction: Excess supply can lead to price collapses, as has historically occurred in the oil market.

Specific data

- Gold: It has offered an average annual return of around 7-9% over the last 20 years, with peaks during economic crises.

- Lithium: The growing demand for electric batteries has driven the price of lithium to grow by more than 400% between 2020 and 2022.

- Brent Crude Oil: It has ranged between $20 and $120 per barrel over the past two decades due to supply and geopolitical factors.

- Copper: Considered the “metal of the future” for global electrification, the price of copper has grown by 70% in the last 5 years.

- Commodity ETFs: Products such as the SPDR Gold Shares ETF (GLD) allow you to invest in gold without the physical costs of storage.

Summary

Investing in commodities offers protection against inflation and an excellent diversification option for a balanced portfolio. However, their high volatility, dependence on external factors, and logistical risks require an informed investor profile with a flexible investment horizon.

Sources

1. World Gold Council – Gold Performance over Time

2. Bloomberg – Commodity Trends and Prices

3. International Energy Agency (IEA) – Global oil market and energy transition.

4. Trading Economics – Historical Commodity Price Data

5. Investing.com – Commodity ETF Information

9. Pension plans

Strengths

- Tax benefits: Contributions to pension plans can reduce the IRPF taxable income, which allows for significant tax savings in the short term.

- Systematic savings: Facilitates the creation of a long-term savings habit, which is especially useful for supplementing the public pension.

- Professional management: The plans are usually managed by financial experts, which reduces the effort and knowledge required by the investor.

Weaknesses

- Lack of liquidity: The invested money cannot be withdrawn until retirement, except in exceptional cases such as serious illness or prolonged unemployment.

- Limited returns: Traditional pension plans tend to have a conservative profile, which limits their profitability compared to other investments.

- High fees: Some plans charge management and deposit fees that can significantly reduce net returns.

Opportunities

- Equity pension plans: There are more and more options for plans with greater exposure to risky assets, which can increase your return.

- Complement to the public pension: Given the uncertainty of the pension system, these products can be a key tool to guarantee financial stability in retirement.

- Flexibility in contributions: Investors can make periodic or extraordinary contributions according to their savings capacity.

Risks

- Uncertainty in future taxation: Current tax advantages could change, affecting the final profitability of the plan.

- Inflation: If the plan’s profitability does not exceed inflation, the purchasing power of the accumulated capital could be reduced.

- Manager dependence: Plan performance highly depends on management decisions, which introduces additional risk.

Specific data

- Tax benefit: In Spain, contributions to pension plans reduce the taxable income for personal income tax purposes up to a maximum of 1,500 euros per year (according to the regulations in force in 2023).

- Average return: Pension plans in Spain offered an average annual return of 2.3% over the last 10 years, according to Inverco data.

- Fees: Management and deposit fees vary but are typically between 0.85% and 1.5% per annum, depending on the type of plan.

- Early redemption: Only possible in exceptional cases such as long-term unemployment, disability, or serious illness.

- Equity plans: These plans, although riskier, can exceed returns of 5-7% per annum, depending on market conditions.

Summary

Pension plans are a solid option for those seeking long-term systematic savings and to take advantage of current tax benefits. However, lack of liquidity, high fees, and the possibility that taxation may change in the future are factors to consider. They are a valuable tool for conservative profiles, although their profitability is often limited.

Sources

1. Inverco – Pension plan returns and commissions

2. El País – Taxation and redemption of pension plans

3. CincoDías – Alternatives to Traditional Pension Plans

4. BBVA – Pension plans: types and tax benefits

5. Rankia – Comparison of pension plans in Spain

10. Crowdlending or P2P lending

Strengths

- Attractive profitability: It offers higher interest rates than traditional products, with returns ranging from 4% to 10% per annum, depending on the borrower’s profile.

- Diversification: Allows the investment to be distributed among several borrowers, reducing risk and adjusting the profile to the investor’s needs.

- Accessibility: With digital platforms, it is possible to invest small amounts of money, from 10 or 20 euros, democratizing access to investment.

Weaknesses

- Default risk: There is a possibility that the borrower will not repay the loan, which implies a partial or total loss of the invested capital.

- Limited liquidity: Once the loan is made, the money is blocked until the borrower pays it back.

- Lack of homogeneous regulation: Although regulation has advanced, not all platforms operate under the same rules, which introduces additional risks.

Opportunities

- Market growth: Alternative financing is expanding, especially in Europe, where the market grew by 48% in 2022 (according to the European Crowdlending Association).

- Social impact: Possibility of financing sustainable projects, SMEs or people with difficulties accessing bank financing.

- Technological innovation: Platform automation facilitates investment and allows for a more rigorous default risk analysis.

Risks

- Lack of guarantees: In the event of default, investments are not usually guaranteed, unless there is a specific protection fund on the platform.

- Economic environment: Economic crises can increase default rates, directly affecting investor profitability.

- Return volatility: Unlike traditional products, income is not specific or constant and depends on borrower compliance.

Specific data

- Average return: European crowdlending platforms have reported average returns between 5% and 7% per annum, according to the European Crowdlending Association.

- Minimum investment: Platforms such as Mintos or Bondora allow you to start investing from as little as 10 euros.

- Default rate: Varies by platform and borrower, with average default rates in Europe ranging from 2% to 5%.

- Investment term: Loans usually have a horizon of 6 months to 5 years, depending on the agreement.

- Growing market: The global crowdlending market reached US$19 billion in 2023 and is expected to increase by 20% annually in the coming years.

Summary

Crowdlending or P2P lending is an investment option that combines attractive profitability with accessibility, allowing investors to participate in the financing of personal or business projects. Although interest rates are high, the risk of default and lack of liquidity are important factors. It is particularly suitable for investors with risk tolerance and a vision of portfolio diversification.

Sources

1. Mintos – Profitability and diversification in P2P lending

2. Bondora – Crowdlending Investment Guide

3. Crowdlending.es – Crowdlending platforms in Spain

4. Rankia – Advantages and risks of crowdlending

5. P2P Market Data – Global Data on the P2P Lending Market

11. Startups and venture capital

Strengths

- High potential returns: Investing in startups can offer extraordinary returns, with cases of capital multiplication x10 or x20 if the company is successful.

- Innovation and growth: Startups are often linked to emerging sectors and disruptive technologies, providing investment opportunities for future businesses.

- Advanced diversification: Including private equity investments can improve the diversification of a portfolio by adding assets that are uncorrelated to traditional markets.

Weaknesses

- High risk of failure: Most startups need to consolidate. Studies indicate that approximately 90% of startups fail in the first five years.

- Almost zero liquidity: The investment is locked up for years until the startup is acquired, goes public, or has a stake sale.

- Requires in-depth analysis: Identifying promising startups requires a high level of knowledge, access to investor networks, and the ability to analyze complex business models.

Opportunities

- Access to fast-growing sectors: Startups in artificial intelligence, biotechnology, fintech, and renewable energies are revolutionizing the market.

- Accessible investment platforms: Tools such as Crowdcube or Seedrs allow small investors to participate in venture capital from small amounts.

- Impact on the real economy: Investing in startups can also generate social and economic implications, financing innovative projects and generating employment.

Risks

- High volatility: Uncertainty in startups is very high, and total capital loss is a real possibility.

- Long-term: Investments in startups usually take between 5 and 10 years to mature, with an uncertain return horizon.

- Difficulty of exit: The resale of startup stakes is complex and depends on specific events such as mergers, acquisitions, or IPOs.

Specific data

- Potential returns: Successful investments can generate 10x to 50x, although the average for the private equity market is around 20% per annum.

- Success rate: Only 1 in 10 startups manages to consolidate and generate significant returns.

- Time to maturity: The average time to profit in private equity is between 5 and 7 years.

- Market volume: In 2022, investment in European startups reached €91.6 billion, with sectors such as technology and healthcare standing out.

- Minimum access: Platforms such as Seedrs allow you to invest as low as €10, making it easy to participate in venture capital.

Summary

Investing in startups and venture capital offers a very high potential return but is accompanied by considerable risk and a long time horizon. This alternative is ideal for investors with high-risk tolerance, long-term vision, and a willingness to support innovation and emerging businesses. Collective investment platforms facilitate access to this asset class, although selecting projects requires careful analysis and acceptance of the possibility of total capital loss.

Sources

1. Crunchbase – Startup Investment Data

2. CB Insights – Venture Capital Statistics

3. Seedrs – Startup investment for small investors

4. Crowdcube – Startup investment platform

5. Statista – Size of the startup investment market in Europe.

12. Savings insurance or Unit Linked

Strengths

- Combination of savings and investment: Savings or unit-linked insurance allows long-term capital accumulation while offering additional insurance coverage.

- Tax benefits: Depending on the country, tax benefits include reducing taxes on premiums paid or tax advantages when surrendering capital.

- Adaptability: They allow for adjusting risk and investment to different investor profiles, from conservative to risky, thanks to the diversification in funds.

Weaknesses

- High costs: Management and insurance fees are usually higher than those of other financial products, which erodes profitability.

- Variable returns: Because they are linked to investment funds, returns may be low in unfavorable market environments.

- Term of permanence: Savings insurance requires medium or long-term commitments (5-10 years), with penalties for early surrender.

Opportunities

- Growing interest in hybrid products: Demand for solutions combining personal protection and savings is rising among more cautious investors.

- Controlled diversification: Investing in different assets through Unit Linked allows for reducing risks without requiring active management by the holder.

- Retirement supplement: They are a valuable tool for long-term financial planning and as a complement to traditional pension plans.

Risks

- Low liquidity: Partial or total redemptions are usually limited and may be subject to penalties or loss of tax benefits.

- – Market exposure: Although managed by insurance companies, unit-linked funds are linked to the performance of mutual funds and, therefore, do not guarantee returns.

- – Complexity: These products can be challenging to understand, especially for investors without advanced financial knowledge.

Specific data

- Performance: Historically, Unit Linked funds offer average annual returns of between 2% and 5%, depending on the risk of the linked fund.

- Costs: Total fees typically range from 1.5% to 3% per annum, including management fees, insurance and other associated expenses.

- Investment term: Generally, savings insurance has a 5 to 10-year horizon, which is ideal for long-term objectives.

- Taxation: In countries such as Spain, unit-linked income is taxed as income from movable capital at 19% to 26%, depending on the amount.

- Guarantees: Unlike other savings insurance, Unit Linked does not guarantee capital, as they depend on the evolution of the financial markets.

Summary

Savings or unit-linked insurance is a hybrid alternative that combines savings and long-term investment with insurance protection. Although they offer tax advantages and allow diversified risk management, their high costs and low liquidity can make this product less attractive. They are recommended for conservative to moderate investor profiles looking for a complement to their long-term financial planning and have a moderate tolerance to market fluctuations.

Sources

1. BBVA – What are Unit Linked

Mapfre – Benefits and risks of Unit Linked Insurance

3. Rankia – Savings and Unit Linked Insurance Analysis

4. HelpMyCash – Savings insurance: comparison and features

5. CincoDías – Unit Linked Profitability and Taxation

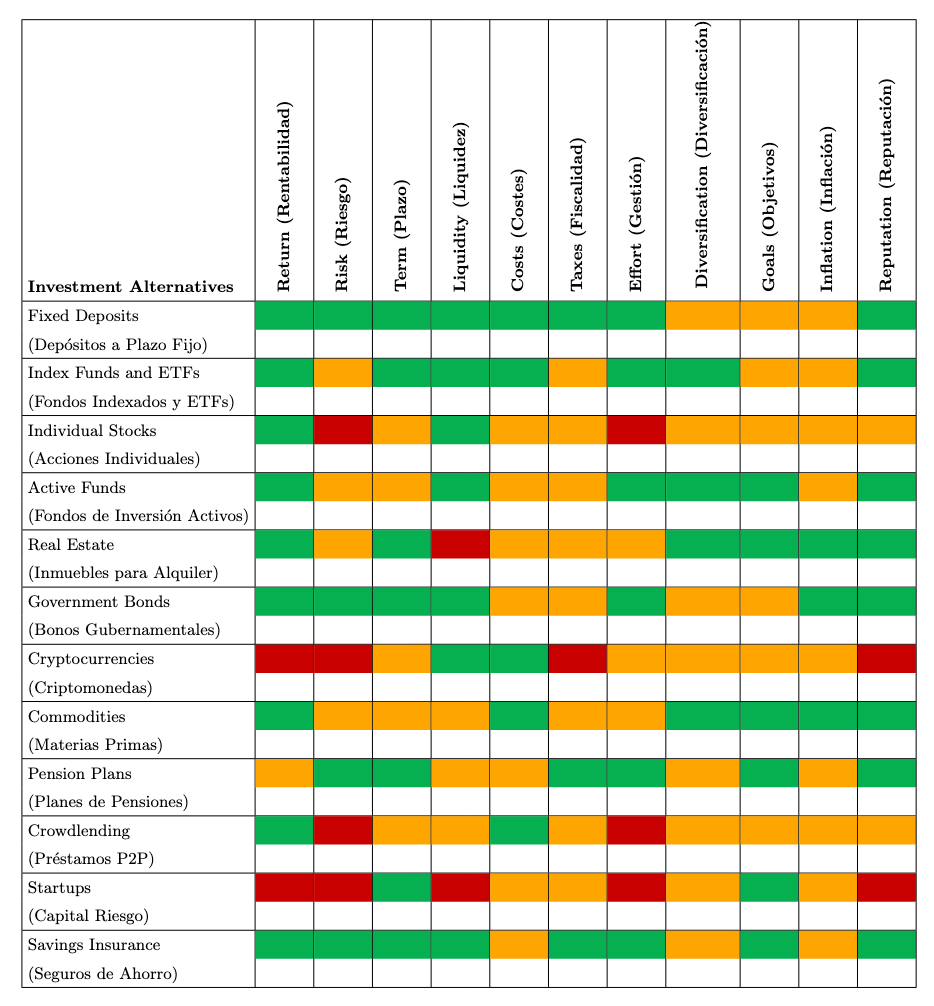

Investment summary table

The table below is a visual summary to help you evaluate and compare at a glance the main investment alternatives based on the 11 key criteria we have defined. These criteria allow you to assess each option from different perspectives, such as expected return, risk, liquidity, and alignment with your objectives.

Table structure

Rows

Each row corresponds to an investment alternative.

- The English name appears at the top of each cell, while its Spanish translation is in parentheses on a second line.

- The 12 alternatives range from conservative options, such as time deposits and government bonds, to riskier strategies, such as cryptocurrencies and startups.

Columns

The columns represent the evaluation criteria used to analyze each investment:

- Return: The expected return on each investment.

- Risk: The level of volatility or probability of loss.

- Term: Time horizon of the investment (short, medium or long term).

- Liquidity: Ease of recovering invested capital.

- Costs: Fees or expenses associated with the investment.

- Taxes: How taxation affects the profits obtained.

- Effort: Level of effort required to manage the investment.

- Diversification: Capacity to diversify risk.

- Goals: Alignment of the investment with your vital objectives.

- Inflation: Protection or vulnerability of investment to inflation.

- Reputation: Soundness and trustworthiness of the issuing asset or entity.

Colors

The color code indicates how each alternative performs about each criterion:

- Green: Favorable or excellent performance in that criterion.

- Orange: Medium or moderate performance, with room for improvement.

- Red: Weak or unfavorable performance in this criterion.

A reflection on rational investment

The decision of where to invest our savings is, without a doubt, one of the most important decisions we will make throughout our financial life. Through this exhaustive analysis, we have explored 12 investment alternatives and evaluated their strengths and weaknesses through objective criteria. This panoramic view is not intended to provide a single answer but to offer a clear and helpful map that every investor can use to make rational, informed, and conscious decisions.

It is critical to understand that no perfect investment or one-size-fits-all strategy exists. The key to success lies in aligning our choices with our life objectives, risk tolerance, and time horizon. Investors must take responsibility for their decisions; information and analysis will always be the best allies. Remember that investing is not an end but a tool to bring us closer to our goals and aspirations.

In future articles of this blog, we will delve deeper into some of these investment alternatives, exploring in more detail how they work, their risks, advantages, and how to get the most out of them. If you are interested in this analysis, stay tuned because we will continue to explain each strategy with the clarity and rigor you deserve.

Conclusion

In closing, let me share a story that illustrates the essence of what it means to invest with purpose. Warren Buffett’s mentor, Benjamin Graham, said that smart investing is “that which combines patience, rationality and long-term vision.” Legend has it that one day, a young investor came to him looking for a get-rich-quick scheme. Graham, in his usual calm manner, responded:

“Investing is not a game of speed, but of discipline and direction. It’s like planting a tree: you choose a strong seed, nurture it with dedication, and give it time. One day, when you least expect it, you’ll enjoy its shade.”

The moral is clear: choose your seeds well, nurture your investment with knowledge and patience, and reap the rewards at the right time. Every decision should be aligned with your objectives, and remember that the safest path is not always the quickest, but it is the most solid.

We invite you to continue exploring the exciting world of finance and investing with us. The next big financial decision can change your life: make sure you make it with awareness and purpose. See you in the following article!

Legal Notice

The content of this article is purely informative and purely informative and educational. It does not constitute financial, tax, or legal advice. Before you make any investment decision, we recommend you consult a qualified professional who can look at your personal and economic situation. Investments involve risks; the investor is responsible for analyzing and assuming those risks.