How technology has transformed your finances: from the abacus to the best tools of 2025

“Innovation distinguishes leaders from followers.” – Steve Jobs, American technology visionary and entrepreneur.

History of financial technology: from currencies to Artificial Intelligence

Since the first merchants drew lines in the sand to count their goods, humanity has sought ways to simplify and optimize money management. Today, with virtual assistants that can remind you to pay a bill or invest automatically while you sleep, the journey of financial technology seems straight out of a science fiction novel. But this journey began thousands of years ago when the tools were as rudimentary as they were brilliant.

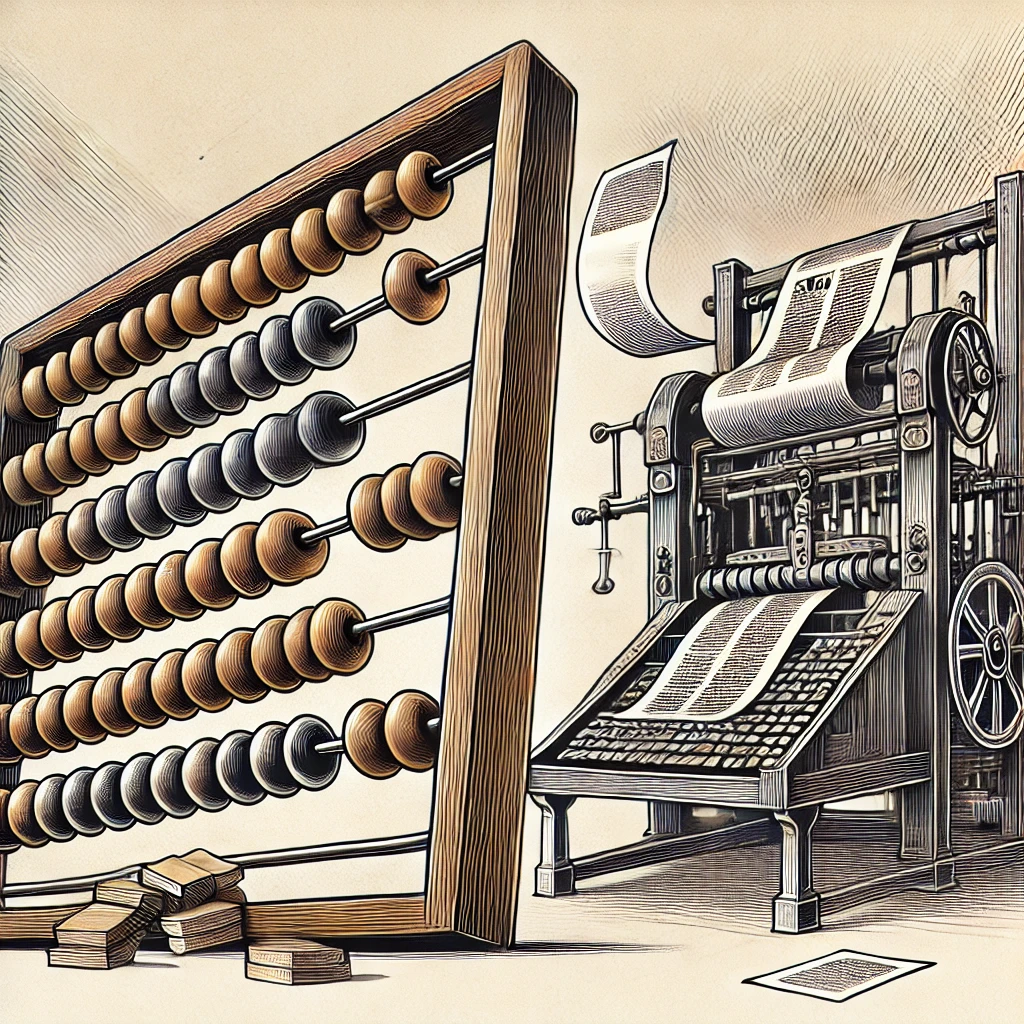

1. The first steps: abacuses and coins (6th century B.C.)

Imagine a merchant in ancient Lydia, surrounded by fabrics, spices, and precious stones, trying to close a deal. His hands pass nimbly across an abacus, that magical tool of wood and beads that made calculations quick and precise. On the other side, his client checks a small bag of freshly minted coins, symbolizing trust and progress in a world where barter is still the norm.

The abacus, born in Asia 5,000 years ago, allowed merchants to prosper and laid the foundations for the first financial “calculators”. With the introduction of coins in Lydia around the 6th century BC, a colossal leap was made: transactions became faster, fairer, and, most importantly, accessible to the masses. Global trade was beginning to take shape.

“Early financial advances, such as the abacus and coins, transformed commerce and laid the foundation for financial technology.”

2. Printing and financial education (15th century)

Fast forward to the 15th century, when Gutenberg’s printing press changed the world. Before this invention, knowledge about personal finance was reserved for elites, hidden away in manuscripts inaccessible to most. However, with the advent of the first printed books, concepts such as saving, investing, and planning began to reach the hands of ordinary people.

Think of a family in Renaissance Europe that, for the first time, has access to a small book that teaches them how to save for an uncertain future. This milestone democratized knowledge and started a silent revolution: financial education as a tool for empowerment.

“The printing press democratized financial education, bringing savings and investment concepts closer to ordinary people.”

3. Banks for the common people (19th century)

With the Industrial Revolution, cities began filling with factories, trains, and banks. Until then, banks were the exclusive bastions of the elite. However, savings banks, designed for the working classes, gave millions of people access to financial tools such as bank accounts and loans for the first time.

Imagine a worker depositing his first salary coins in a local savings bank. That simple gesture represented more than money; it was hope, a promise of the future, of being able to plan and dream. This breakthrough changed individual lives and laid the foundation for the modern economy.

“Modern banks empowered the working classes, making savings and financial planning accessible.”

4. The electronic calculator (1970s)

Enter a 1970s kitchen, where a mother is adjusting the family budget. In her hands, a shiny new electronic calculator converts complicated interest formulas into simple numbers. This small device, which came into homes thanks to advances in electronics, marked a crucial change: for the first time, families could manage their finances accurately and quickly.

Until then, financial calculations relied on pencil and paper or the help of experts. With calculators, anyone, regardless of their level of education, could take control of their budget and better plan their future.

“The electronic calculator brought financial accuracy to households, simplifying money management.”

5. The digital revolution: the Internet and online finance (1990s)

As the world entered the digital age, finance also took an impressive leap forward. Online banks allow people to access their accounts from home, make transfers in seconds, and, most revolutionarily, compare prices and services in real time.

For the first time, the relationship with money became genuinely global. A family in New York could pay their children’s tuition fees in London with a single click. The Internet removed barriers and opened up various learning, saving, and investing possibilities with tools such as loan simulators or free online courses.

“The Internet transformed personal finance by making it more accessible and global.”

6. Smartphones and financial apps (2008 onwards)

With smartphones, everyone started carrying a financial office in their pocket. Apps like Mint and Venmo simplified budgeting, made it possible to split bills in seconds, and offered reminders so you wouldn’t forget to pay bills.

The most amazing thing? Anyone could start investing with just a few dollars, something unimaginable decades ago. Apps like Robinhood removed barriers and democratized access to the stock market, while platforms like PayPal connected millions of people to global trading.

“Mobile apps transformed smartphones into essential tools for financial management.”

7. Artificial Intelligence and financial automation (current events)

Today, we live in a world where technology helps and thinks for us. With virtual assistants like Alexa, you can set payment reminders or ask how much you’ve spent in a month. AI platforms like Acorns automate savings and adjust investments based on your habits and goals.

The future? Fully personalized financial management, where technology not only simplifies but empowers.

“Artificial intelligence takes financial management to an unprecedented level of personalization.”

Tech gadgets that optimize your finances

Today, we live in a world where technology accompanies and guides us. What was once an arduous task of calculation and planning has now become an automated and efficient process thanks to tools that fit in the palm of our hand or respond to a simple voice command. Modern tools make it easier to manage money and ultimately transform our relationship with it, giving us more control and clarity over our finances.

This section will explore some of the most innovative gadgets and devices you can incorporate into your daily life to optimize your financial management. From smartwatches that keep you on top of your spending to virtual assistants that help you organize your payments, these tools are designed to simplify money management, make it more efficient, and, in many cases, even make it fun.

For your convenience, we have included links to some of the technological devices we will include in this list, allowing you to learn more about them and how they can be integrated into your daily life. In addition, these links contribute to maintaining this informative space, without generating any additional cost to you.

1. Smartwatch: the invisible ally of your finances

Imagine that while running through the park, your smartwatch measures your heart rate and reminds you that you’re close to reaching your weekly entertainment budget. This small but powerful device does more than tell you the time; it’s a faithful ally in keeping you focused on your financial goals. Thanks to its advanced technology, a smartwatch can help you track your spending, receive alerts about pending payments, and even monitor the impact of your financial decisions in real time.

The best smartwatches for finance combine style and technology and become essential for anyone looking to improve their relationship with money. With options to sync with budgeting apps like Mint or YNAB and features like tracking spending habits, these pieces of wearable financial technology can make a significant difference in your daily life.

Are you ready to revolutionize your financial management? Explore the top-rated smartwatches of 2025 that combine style and functionality that combine style and functionality, and take the first step toward a more efficient financial future.

2. Virtual assistants: your financial advisor at home

Imagine you’re making your morning coffee when, with a simple voice command, Alexa reminds you that your rent is due today. Minutes later, you ask her how much you’ve spent this month on entertainment, and she responds with a precise figure, helping you adjust your budget. No, it’s not science fiction; it’s the transformative reality that virtual assistants have brought to our homes.

The best virtual assistants not only make your life easier by organizing your calendar or playing your favorite songs, but now they also act as true personal financial advisors. With features that include payment reminders, quick expense calculations, and even advice on your spending habits, these devices are redefining how we manage our finances from the comfort of our home.

In addition, tools like Alexa or Google Nest can integrate with your favorite budgeting apps, taking you one step closer to fully automated financial management. You no longer need to worry about forgetting a bill or going over budget; your virtual assistant takes care of everything.

Would you be ready to leap? Bring the future into your home with the most advanced virtual assistants and experience a new era of financial control with just your voice.

3. Investment platforms for beginners

Investing is no longer a luxury reserved for financial experts. Today, with apps such as online brokers, anyone can start building a portfolio from scratch with just a few euros. These platforms have democratized the investing world, allowing people of all ages and experience levels to enter the financial market without complications.

Imagine opening your smartphone or tablet, exploring investment options, and making your first stock purchase while sipping your morning coffee. These tools simplify the process and offer educational resources, easy-to-interpret charts, and strategies tailored for beginners. From automated trading to customized options, the best trading platforms for beginners are designed to help you take your first steps with confidence.

The right device is all you need to make the most of these opportunities. A tablet optimized for trading gives you the ideal screen for analyzing trends and ensures smooth performance while managing your investments.

Ready to start your financial journey? Connect with the economic marketplace through your smartphones or tablets, which are ideal for trading, and discover how easy it can be to become an investor today.

4. Subscription management tools

Would you happen to know how much you spend each month on subscriptions? From streaming platforms to online fitness services, it’s easy to lose track of those small monthly charges that add up quickly. This is where subscription management tools like Truebill come in.

These apps are designed to simplify your financial life by automatically identifying all your active services, showing you exactly how much you’re spending, and allowing you to cancel the ones you no longer use. You can eliminate those unnecessary expenses and redirect your money toward more important goals with a few clicks. The best part is that these apps also automate savings, helping you reach your financial goals effortlessly.

To get the most out of these tools, you need a powerful device that is fast, intuitive, and reliable. Whether you’re checking your subscriptions from a tablet or smartphone, having the right equipment will make your experience even smoother and more efficient.

Get the most out of these apps with the best smartphones or tablets and take control of your monthly expenses today; your wallet will thank you!

5. Smart energy saving: the key to reducing bills with technology

The real magic of technology happens when it takes over your finances and home. Imagine your thermostat automatically adjusting the temperature to save energy when you’re not at home or the lights turning themselves off when you leave a room. Financial and home automation go hand in hand, helping you reduce bills, save energy, and put those savings toward your financial goals.

Today, home automation devices bring comfort and are a wise investment for your pocket. Smart thermostats, programmable plugs, and voice-controlled LED bulbs are tools that can optimize energy consumption and reduce your monthly costs. All while allowing you to manage your home from an app, giving you complete control over your energy expenses.

Connecting your home to technology has never been so accessible. Discover smart home automation gadgets that make your life easier and take care of your economy and the environment.

You can explore the most affordable home automation devices and start saving today. Your home and your wallet will thank you.

6. The importance of financial literacy: learn to manage your money through reading.

In a world where financial decisions affect every aspect of our lives, personal finance education is not just an asset; it’s a necessity. The good news is that learning how to manage your money effectively has never been easier. With a simple investment of time and reading, you can discover strategies for saving, investing, and planning for your financial future.

Personal finance books offer you knowledge and practical guidance based on real-life experiences from experts. From tips for getting out of debt to strategies for growing your wealth, reading is a powerful tool for taking control of your finances. Resources are available to everyone in print, on a Kindle, or through audiobooks with an Audible subscription.

Imagine reading on your Kindle at night about creating an efficient budget or listening to an audiobook on your daily commute that inspires you to start investing. These tools transform your mindset and equip you with the skills to build a solid financial future.

Essential books to transform your finances

- “The Psychology of Money“ by Morgan Housel: A fascinating approach to how our emotions and habits impact our financial decisions. Enjoy it on Kindle or listen to it on Audible.

- “Rich Dad, Poor Dad“ by Robert Kiyosaki: A classic for understanding the difference between assets and liabilities and how to build wealth. Enjoy it on Kindle or listen to it on Audible.

- “The Richest Man in Babylon“ by George S. Clason: A masterpiece that combines ancient stories with timeless financial lessons. Enjoy it on Kindle or listen to it on Audible.

7. Digital wallets for cryptocurrencies: The key to protecting your digital assets.

In the age of cryptocurrencies, where money no longer has a physical form, security and control of your digital assets are more critical than ever. This is where digital wallets for cryptocurrencies come into play, essential tools for storing, sending, and receiving digital currencies such as Bitcoin, Ethereum, or any other token in this exciting financial ecosystem.

What is a digital wallet for cryptocurrencies?

Imagine having a complete bank in your pocket without intermediaries or office hours. A digital wallet represents a software or physical device that allows you to interact with the blockchain to manage your cryptocurrencies. With a wallet, you hold the keys – literally. The private keys controlling your assets are yours and yours alone, ensuring you have absolute power over your money.

Types of digital wallets: find the one that fits you best

- Cold wallets (hardware wallets) are ideal for those seeking maximum security. They are virtually immune to hacking because they are disconnected from the Internet. You can explore the best hardware wallets here.

- Hot wallets (software wallets): Perfect for everyday use, these wallets run on your smartphone or PC and are ideal for quick transactions.

- Multi-signature wallets: A further step in security, they require the authorization of multiple private keys for transactions, making them a robust option for serious investors.

Why you need a digital wallet for cryptocurrencies

In a world where cryptocurrency adoption is booming, relying on a centralized exchange to store your funds can be an expensive mistake. With a digital wallet, you have complete control and protection against possible platform crashes or digital theft.

Example: Imagine you have invested in Bitcoin and decided to store it in a hardware wallet like Ledger. With this device, you can disconnect your funds from the network, protecting them from any hacking attempt, and you can take it with you anywhere!

Embrace technology that transforms finance

Cryptocurrencies are the future of finance, and digital wallets are the tool that will allow you to make the most of them. Whether you are a beginner exploring Bitcoin or an expert diversifying your portfolio, choosing the right wallet is the first step to securing your assets.

Protect your cryptocurrencies and take control of your financial future. Discover the best digital wallets for cryptocurrencies for cryptocurrencies here and join the digital revolution safely and efficiently.

8. Prepaid cards and credit card protectors: security and control at your fingertips

In a world where digital transactions are the norm, prepaid cards, and credit card protectors have become essential allies for those looking to manage their money securely and conveniently. These tools make your purchases easier and add protection and control to your financial life.

Prepaid cards: full control of your expenses

Do you ever feel like you lose control of your spending using a traditional credit card? Prepaid cards are the perfect solution. They work like a digital wallet: you decide how much to charge on them, eliminating the risk of overspending. They are also ideal for online shopping, travel, or even teaching youngsters how to manage their money.

Main advantages:

- No linkage to bank accounts.

- Greater security in online purchases.

- Total budget control.

Practical example: Imagine you are planning a trip abroad. Loading a prepaid card with a specific amount ensures you won’t exceed your budget, even if shopping temptations increase.

Explore the best prepaid cards here and find the option that fits your financial needs.

Credit card protectors: security that travels with you

Credit cards are powerful tools, but they are also vulnerable to risks such as data theft through RFID technology. This is where card protectors, such as anti-RFID cases and wallets, become indispensable. These devices block unauthorized signals, ensuring no one can scan your financial information without your consent.

Main advantages:

- Protect against digital theft.

- Compact and easy to use.

- Ideal for frequent travelers and public transportation users.

Practical example: While waiting in a busy train station, a wallet with an anti-RFID wallet with an anti-RFID protector, I want you to know that your cards are shielded against possible wireless hacks.

Discover anti-RFID credit card protectors here and take your financial security to the next level.

9. Intelligent safes: State-of-the-art security to protect your assets

In a world where more and more aspects of our lives are digital, it remains vital to protect our physical assets. From important documents and cash to jewelry or valuable keepsakes, smart safes offer a modern, technological solution to secure everything hassle-free and with quick and efficient access.

What makes a safe smart?

Forget about old combinations that you can forget or quickly lose keys. Smart safes incorporate advanced technologies such as biometric recognition, mobile app access, real-time alerts, and compatibility with IoT devices. These features not only make them more secure but also more practical for modern life.

Key advantages:

- Fingerprint recognition: Only you or authorized persons can open it.

- Connection with mobile apps: Receive alerts if someone tries to tamper with the box or if it is improperly closed.

- Compatibility with virtual assistants: Some integrate with devices such as Alexa or Google Home for ease of use.

Security and finance: an essential combination

Protecting your physical assets is an extension of sound financial planning. Imagine storing your legal documents, cash, and jewelry safely without worrying about loss or theft. In addition, smart safes are ideal for storing private keys to cryptocurrencies, creating a hybrid solution between physical and digital security.

Practical example: Storing a physical copy of your private cryptocurrency keys in a safe with biometric recognition adds an unsurpassed layer of security for your digital investments.

What is the ideal smart safe for you?

Recommended models:

- Yale Smart Safe: Compact, with biometric access and Bluetooth connection to manage everything from your cell phone. You can discover it here.

- WASJOYE: Specially designed to combine physical and digital security, ideal for storing hardware wallet devices. Please get it here.

- ARREGUI AWA: Opening with electronic code, mobile app management, and Amazon Alexa compatibility. Available here.

Why invest in a smart safe today?

A smart safe is not just a security device but an investment in peace of mind. Whether to protect your most valuable assets or manage your important documents, these tools combine state-of-the-art technology and practical design to offer you the best security.

Make safety your priority.

Explore the best smart safes here and discover how to protect what matters most with the most advanced technology on the market.

10. Advanced financial calculators: accuracy at your fingertips

In a world dominated by apps and mobile devices, advanced financial calculators remain indispensable tools for professionals, students, and anyone who needs to perform complex calculations accurately and quickly. These calculators simplify tasks such as compound interest calculation, loan amortization, or investment analysis and offer a level of reliability that many mobile apps cannot match.

Why do you need a financial calculator?

While apps are handy for everyday tasks, there are times when you need a device that is designed exclusively for solving financial problems. Advanced financial calculators allow you to perform detailed calculations without distractions or an Internet connection, making them a reliable tool for those in finance, accounting, or investments.

Main advantages:

- Compound interest and net present value calculations.

- Cash flow analysis for investment decisions.

- Ergonomic design and fast keys for continuous use.

Practical example: Imagine you are evaluating the feasibility of an investment project. With a calculator such as the Texas Instruments BA II Plus calculator, you can quickly calculate the ROI (return on investment) or the time needed to recover your capital.

Recommended calculators for superior performance

- Texas Instruments BA II Plus: Ideal for finance students and professionals who need advanced functions such as depreciation calculations, present value, and cash flow analysis. Please get it here.

- HP 12C Financial Calculator: A classic in the financial world, known for its robustness and intuitive functions for quick calculations. You can just discover it here.

- Casio FC-200V: Compact and perfect for those looking for an economical but powerful calculator for financial calculations. Available here.

An essential ally for your studies and your career

Whether studying for a finance exam, analyzing investment options, or evaluating a loan, an advanced financial calculator is a must-have tool. Their accuracy, durability, and specific functionalities make these calculators an investment that will quickly pay for itself.

Take your accuracy to the next level

You can explore the best financial calculators here and choose the tool to accompany you in your academic and professional challenges.

Conclusion: your financial future starts today

The journey we’ve traveled together is more than a list of tools or devices; it’s an invitation to reimagine how you manage your finances and life. From smartwatches to financial calculators, technology doesn’t just transform numbers; it transforms decisions, behaviors, and, above all, opportunities.

Today, you have more power than ever to take control of your finances, simplify your day-to-day life, and secure your future. Each tool mentioned here opens the door to a more organized, efficient, and promising world. Are you ready to walk through it?

Financial technology is not the future; it is the present you can embrace now. As Benjamin Franklin once said, “Time is money.”

And right now, the time you spend adopting these tools can make the difference between simply keeping up and leading your way to financial freedom.

Change starts with you. Explore the recommended options, select the ones that resonate with you, and become the absolute master of your financial destiny.

Could you let me know what you’re waiting for? Click on the links, discover how technology can work for you, and make the first decision to transform your bank account and life.