The Best-Kept Secret of Economics: How Money is Created

“Monetary counterfeiting carried out by central banks is inflationary, distorts the economic system, and is equivalent to the stealthy theft of citizens’ property.” – Murray Rothbard, American economist and political theorist.

Unveiling the Origin of Money

The creation of money is one of the best-kept secrets in Economics. Although we use money daily to buy, pay, and save, few truly understand where it comes from. Some might think that all money is printed by Central Bank machines, but the reality is far more complex, fascinating, and often bewildering.

Money: Much More Than Banknotes and Coins

Money is not just the cash we carry in our pockets. Its creation depends on a complex, multi-faceted system that includes various types of assets, each created by different actors:

- Banknotes and Coins: These are created by the Central Bank to facilitate daily transactions between people and businesses. Their value is no longer backed by precious metals, as in the past, but rather by public trust in the financial system and government regulations ensuring their acceptance.

- Government Debt: Issued by governments through instruments such as bonds and Treasury bills, its primary purpose is to finance public projects and cover state expenses. This debt is backed by the government’s ability to collect taxes and maintain long-term solvency, making it a key tool for economic development.o que la convierte en una herramienta clave para el desarrollo económico.

- Bank Reserves: Created by the Central Bank, bank reserves are used exclusively in transactions between commercial banks. They ensure liquidity in the financial system and preserve its stability. Their backing lies in the Central Bank’s authority to issue currency and manage the money supply.

- Bank Deposits: Commercial banks create this type of money when they issue loans to individuals and businesses. Its purpose is to drive consumption and investment through the provision of credit. The value of bank deposits depends on confidence in the bank’s solvency and the underlying assets backing the loans.

Imagine the money creation system as a “trust game.” For everything to function, people, businesses, and governments must trust that the money they use will maintain its value and be accepted by others. Without this trust, the entire system would collapse.

Why Understanding This Matters

Understanding how money is created helps us unravel many of the mysteries of modern Economics. It allows us to answer questions such as:

- What is the origin of inflation?

- Why are commercial banks so important to the Economy?

- How do Central Bank decisions impact our daily lives?

- What is the Government’s role in ensuring economic stability when issuing debt?

In the following sections, we will explore how the Government, the Central Bank, and commercial banks work together (and sometimes in conflict) to create the money we use daily.

Accounting in Money Creation

A crucial concept in understanding money creation is the effect of double-entry accounting. All money created must have a counterpart, as money does not appear out of thin air; it always represents debt somewhere in the system.

The Accounting of Bank Reserves

Bank reserves are created when the Central Bank credits commercial banks’ accounts, usually in exchange for assets such as government bonds or financial securities. In the Central Bank’s accounting, these reserves are recorded as a liability, representing money available for commercial banks. Simultaneously, the Central Bank adds an asset to its balance sheet through the bonds or assets acquired in the operation.

From the commercial bank’s perspective, bank reserves are an asset that can be used for interbank payments or to meet minimum reserve requirements.

This system ensures sufficient liquidity in the financial system and reinforces the confidence that banks can meet their payment obligations among themselves and their customers.

The Accounting of Circulating Money

When a commercial bank requests circulating money (banknotes and coins) from the Central Bank, an exchange of liabilities occurs in the Central Bank’s balance sheet. The commercial bank’s reserve, recorded as a Central Bank liability, decreases, while circulating money increases in the same proportion as a new liability. This does not create new assets for the Central Bank but changes the composition of its liabilities.

From the commercial bank’s perspective, this operation involves an exchange of assets: it reduces its bank reserve balance and converts it into physical cash. The circulating money received meets cash demand from citizens or businesses. For a citizen withdrawing cash from an ATM, the operation is also an asset exchange: their bank deposit decreases, and they receive banknotes and coins in return.

The Accounting of Bank Deposits

Bank deposits are a fundamental part of the money creation process. When a citizen deposits money in a commercial bank, this accounting record translates into an increase in the bank’s liabilities (the customer’s deposit) and, simultaneously, its assets (cash or bank reserves at the Central Bank).

When a commercial bank grants a loan, the money does not come directly from its reserves; instead, a new deposit is created in the borrower’s account. In accounting terms, the bank records a new asset (the granted loan) and a new liability (the deposit created in the client’s account). This process is known as bank money creation since loan issuance increases the amount of deposits in the financial system.

However, the bank must carefully manage its liquidity and reserve levels to meet withdrawals and interbank payments. Therefore, it is subject to minimum reserve requirements and regulations that limit the amount of money it can generate through lending.

The Accounting of Public Debt

This dynamic also applies to government debt. When a government issues bonds, they represent a promise of future payment backed by state tax revenues. The buyers of these bonds receive an asset (the bond) in exchange for the money they provide (an asset for the state), but that money is also recorded as public debt (a liability for the state). For the bond buyer, the transaction is an asset exchange from an accounting perspective: one type of money (bank deposit) for another (public debt).

Understanding M0, M1, M2, and M3: Monetary Aggregates and Their Impact

The monetary aggregates M0, M1, M2, and M3 are different measures of the amount of money circulating in an economy. Each includes various components of money, ranging from the most liquid to more restricted forms.

M0: Monetary Base

Also known as the monetary base or high-powered money, it represents the total amount of money issued directly by the Central Bank and forms the foundation upon which the money supply expands through the banking system. It consists of:

- Banknotes and coins in circulation are held by the public (citizens and businesses).

- Bank reserves at the Central Bank, are divided into required reserves (which banks must maintain) and excess reserves (additional funds that can be used for loans or interbank payments).

What role does it play in the Central Bank’s balance sheet?

- It is recorded as a liability since banknotes and reserves are obligations of the Central Bank.

- The corresponding assets include government bonds, bank loans, and foreign exchange reserves.

M0 is the money that only the Central Bank can create directly. However, most of the money in the economy originates from the banking system through the money multiplier when banks grant loans and generate additional deposits.

M1: Money in Circulation and Demand Deposits

M1 is the most liquid monetary aggregate representing the money immediately available for economic transactions. Its importance lies in its direct relationship with consumption, inflation, and monetary policy. It consists of:

- Banknotes and coins in circulation.

- Demand deposits in commercial banks (checking accounts).

It does not include less liquid assets such as term deposits or savings accounts with restrictions.

What impact does it have on the economy?

- An increase in M1 indicates greater money availability for consumption, which can boost economic growth.

- Uncontrolled M1 growth can create inflationary pressures since excess circulating money can increase prices.

- Central banks monitor M1 to adjust the money supply and control inflation:

- Expansion: Lowering interest rates or purchasing assets (government bonds) in exchange for bank reserves, increasing commercial banks’ lending capacity.

- Contraction: Raising interest rates or selling assets to reduce bank reserves decreases banks’ lending capacity.

M2: Indicator of Spending and Savings Capacity

M2 reflects the money available in the economy for consumption and short-term investment. An increase in M2 is usually associated with higher economic activity, while a contraction can signal a slowdown or liquidity shortage. It consists of:

- M1 (circulating money plus demand bank deposits).

- Savings and term deposits.

What impact does it have on inflation and monetary policy?

- Excessive M2 growth can generate inflation since more available money can increase demand and prices.

- M2 contracts too much can lead to deflation or lower growth, affecting consumption and investment.

- Central banks monitor M2 to adjust monetary policy according to the economy’s needs.

M3: The Broadest Money Supply

M3 reflects the total amount of money and liquid assets available in the economy, including those not immediately usable but convertible into cash relatively quickly. It consists of:

- M2 (circulating money plus demand deposits plus savings and term deposits).

- Long-term deposits and bank-issued bonds from commercial banks, investment banks, or financial entities are used to raise funds.

M3 is the broadest indicator of the money supply, reflecting not only circulating money but also credit and liquid assets in the financial system. Its regulation through interest rates, government bond purchases and sales in the open market, and reserve requirements for lending is key to maintaining the balance between economic growth, financial stability, and inflation control.

Mandates and Operational Mechanisms of the Central Bank

Each Central Bank may have different objectives depending on the country’s legal framework, but the most common ones are:

Price Stability

- Controlling inflation to prevent excessive price increases or deflation.

- Achieved through interest rate adjustments and money supply regulation.

Full Employment and Economic Growth

- Promoting credit access and economic dynamism without overheating.

- Balanced with inflation control to avoid distortions.

Financial System Stability

- Supervising banks and other institutions to prevent banking crises and systemic risks.

- Achieved through prudential regulation and liquidity provision in crisis situations.

Foreign Exchange Market Regulation

- In some countries, the Central Bank intervenes in the currency market to stabilize the currency and prevent extreme volatility.

- Balanced with inflation control to avoid distortions.

To fulfill these mandates, the Central Bank employs various instruments, including Quantitative Easing (QE) and Quantitative Tightening (QT):

Quantitative Easing (QE)

Quantitative Easing (QE) is an unconventional monetary policy that stimulates the economy when interest rates are near zero or negative. How does it work?:

- The Central Bank purchases financial assets, primarily government bonds and, in some cases, corporate bonds or mortgage-backed securities.

- In return, it injects money into the banking system (increasing bank reserves), boosting liquidity and encouraging credit and investment.

Objective: Reduce financing costs, stimulate consumption and investment, and prevent prolonged recessions or crises.

Expected effects of QE:

- Lower long-term interest rates, facilitating credit access.

- Increased bank credit for businesses and consumers.

- Higher asset values encourage investment and consumption.

- Weaker local currency, favoring exports.

Potential risks of QE:

- Excessive inflation if too much money is injected without productive backing.

- Financial bubbles as investors may take excessive risks.

- Dependence on stimulus makes monetary policy normalization difficult.

For example, QE programs by the Federal Reserve (FED) and the European Central Bank (ECB) after the 2008 financial crisis and the 2020 pandemic helped stabilize markets and prevent a deep depression.

Quantitative Tightening (QT)

Quantitative Tightening (QT) is the opposite of QE’s policy. It reduces the money supply and normalizes financial conditions after excessive stimulus. How does it work?

- The Central Bank sells financial assets (government or corporate bonds) or allows held bonds to mature without reinvesting.

- This absorbs liquidity from the financial system, reducing the amount of available money.

Objective: Control inflation, stabilize growth, and prevent financial bubbles.

Expected effects of QT:

- Higher interest rates, slowing credit and inflation.

- Reduction of excess liquidity, normalizing financial markets.

- Stronger local currency increases its value as less money is in circulation.

Potential risks of QT:

- Economic slowdown if applied too quickly or at the wrong time.

- Financial market volatility due to reduced liquidity.

- Increased financing costs for governments, businesses, and households.

For example, after years of QE, the FED initiated a QT program in 2017, reducing its balance sheet and gradually raising interest rates. However, in 2019, some measures were reversed due to market instability.

All Money is Debt, and All Debt is Money

In the modern financial system, money and debt are two sides of the same coin. Unlike what many people believe, money is not backed by physical assets like gold but is issued as debt through the banking system and the Central Bank. This creates a dynamic where the expansion of money depends on the continuous growth of credit.

The Origin of Money as Debt

The money in circulation primarily comes from bank loans. When a commercial bank grants a loan, it does not disburse money from its deposits but creates new money in the borrower’s account. In accounting terms:

- The bank generates an asset (the loan) on its balance sheet.

- At the same time, it creates a liability (the deposit in the client’s account).

This process means that every unit of money in circulation represents debt somewhere in the financial system. If loans were not repaid, that money would disappear, reducing the money supply and affecting the economy.

This process has a key implication: credit must continuously expand for the economy to grow. If debt were to stop growing, the economy would contract.

The Interest Problem: Uncreated Money

The money in circulation primarily comes from bank loans. When a commercial bank grants a loan, it does not disburse money from its deposits but creates new money in the borrower’s account.

One of the most critical aspects of this system is that when banks create money through loans, they do not create the money needed to pay the interest.

- If a bank grants a $100,000 loan at a 5% interest rate, the borrower must repay $105,000 at the end of the term.

- However, the system only created $100,000, so the money to pay the interest must come from new loans or the default of other debtors.

As a result, the economy requires perpetual credit expansion to avoid collapses. Without new loans, some economic agents would be unable to pay their debts, leading to defaults, banking crises, and recessions.

Inflation as a Mechanism to Reduce Debt

Since debt in the financial system must continuously grow, inflation becomes a fundamental tool to reduce the real burden of debt.

How Inflation Works in Public and Private Debt:

- Governments borrow by issuing bonds.

- With inflation, money loses value over time, meaning that past debt is repaid with less valuable money.

- The government benefits because tax revenues grow with inflation, while previously issued debt remains unchanged in nominal terms.

Hidden Cost: The Impoverishment of the Population

- Citizens see the purchasing power of their savings and wages decline.

- Savings in cash lose value compared to assets like real estate or stocks, benefiting those who have access to those assets.

- This results in a wealth transfer from workers and savers to debtors and the government.

Conclusion: Inflation is not merely a “rise in prices” but an indirect way to reduce the real value of debt at the cost of eroding the population’s purchasing power.

The Cantillon Effect: How Money Creation Favors the Wealthy

The Cantillon Effect, described by economist Richard Cantillon in the 18th century, explains how monetary expansion benefits certain groups before affecting the rest of the economy.

Mechanism of the Cantillon Effect:

- Newly created money enters the economy through banks and large corporations.

- Banks and large investors receive the new money before the general population.

- They use it to buy assets like stocks and real estate, driving up their prices before wages or consumer goods increase.

- The working and middle classes only experience inflation in consumer goods but do not receive the benefits of monetary expansion.

Conclusion: Monetary expansion increases inequality because the wealthiest have access to new money before most of the population.

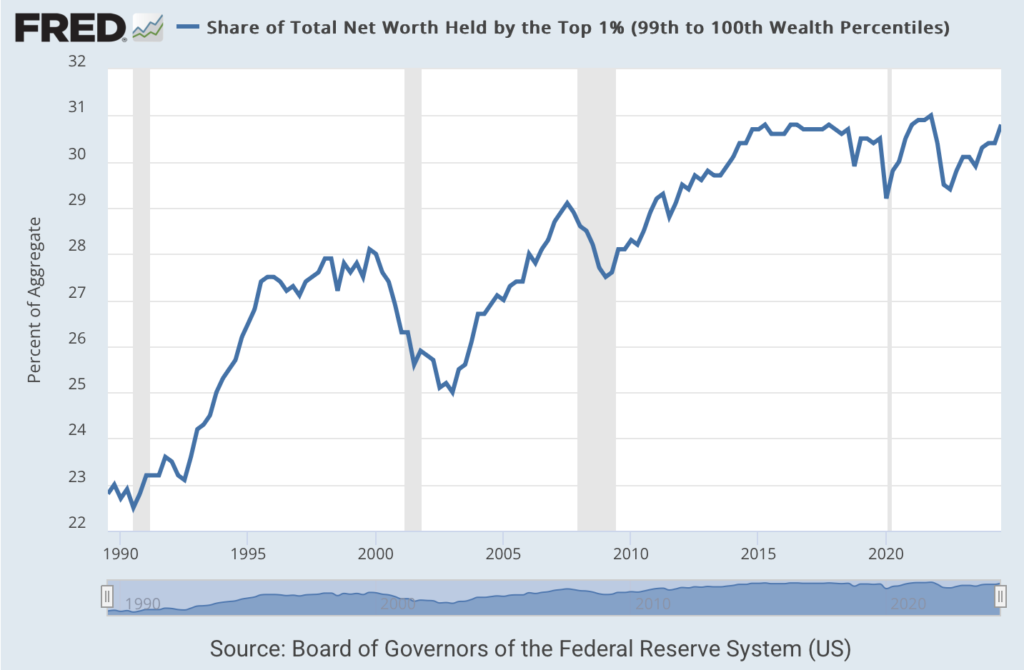

The Evolution of Wealth Accumulated by the Top 1%

To illustrate how this system benefits a small elite, we can analyze the evolution of the wealth held by the richest 1% of the population relative to the rest.

Key Data:

- In recent decades, the share of wealth held by the richest 1% has increased dramatically.

- Inflation, privileged access to credit, and financial asset investments have been key factors in this process.

- As the financial system expands through debt and the Cantillon Effect occurs, the wealthiest capture an increasing share of total wealth. At the same time, most of the population experiences a decline in purchasing power.

Conclusion

Imagine a game of Monopoly with a special rule: some players start before others. By the time the latecomers arrive, the best properties have already been bought, and their owners have mortgaged them to acquire even more assets. When the new players receive their money, prices have risen, rents are higher, and their chances of competing are minimal. No matter how well they play, they will always be at a disadvantage.

This is how our financial system works. Money is neither a neutral good nor distributed equitably; it is created as debt and first given to those closest to its source: banks and large corporations. While the first recipients of new money use it to buy assets before prices rise, the rest of the population only sees it when inflation has already eroded their purchasing power. This is the Cantillon Effect in action—a silent mechanism that transfers wealth to those with privileged access to credit.

The problem is not just that all money is debt, but that the money to pay interest is never created. This forces a perpetual cycle of refinancing, credit expansion, and periodic crises. Inflation, far from being a natural phenomenon, is a tool to reduce the debt burden at the cost of impoverishing the majority. Those who own assets benefit, while those dependent on wages see their earnings buy less and less.

This is not about conspiracies or miscalculations—it is the very architecture of the system. Henry Ford once said: “It is well that the nation’s people do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Perhaps the question is not how to win this game, but why we keep playing by its rules.

Additional Resources

Books on Money Creation

- “A History of Money: From Ancient Times to the Present Day“ by Glyn Davies. This comprehensive book traces the development of money from ancient civilizations to modern economies. It explores how various forms of money have evolved and the economic, political, and social factors influencing this evolution. The author delves into the origins of monetary systems, the role of money in different societies, and the impact of monetary policy throughout history.

- “The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness“ by Morgan Housel. This book offers insights into the behavioral aspects of money and finance. Through short stories, Housel examines how people think about money and how their behaviors influence financial success. The author emphasizes that economic decisions are often driven by personal experiences and emotions rather than logical calculations, providing readers with a deeper understanding of the psychological factors in financial decision-making.

- “The Ascent of Money: A Financial History of the World“ by Niall Ferguson. Ferguson provides a detailed account of the history of finance, exploring the origins of banking, the bond markets, and the stock exchange. He discusses how money and financial systems have shaped human history, influencing empires, wars, and economies. The book also examines the causes and consequences of economic crises, offering insights into the complex relationship between money and power.

- “Debt: The First 5,000 Years“ by David Graeber. In this book, anthropologist David Graeber explores the concept of debt and its role in human societies over millennia. He challenges conventional economic theories by examining the historical and cultural contexts of debt, money, and barter systems. Graeber’s analysis provides a fresh perspective on the origins of money and the moral implications of debt in various cultures.

- “Money: The Unauthorized Biography“ by Felix Martin. Martin offers an unconventional history of money, presenting it as a social technology invented to manage relationships between creditors and debtors. The book explores money’s philosophical and practical aspects, tracing its development from ancient Mesopotamia to the modern financial system. Martin’s narrative challenges traditional views of money and provides a thought-provoking analysis of its societal role.

These books can be found on Amazon in their paper version, in their version for Kindle version, or as an audiobook for a subscription to Audible.

The links above are affiliate links, meaning if you decide to purchase them, the blog will receive a small commission at no additional cost. This partnership helps keep the content free, informative, and quality.

Movies and Documentaries on Prime Video

- “Money For Nothing: Inside the Federal Reserve” (2013). This documentary provides an in-depth look at the Federal Reserve, the central banking system of the United States. It examines the history and policies of the Fed, offering insights into how money is created and managed within the U.S. economy. The film features interviews with economists, historians, and former Federal Reserve officials, shedding light on the complexities of monetary policy and its impact on the financial system.

- “Banking on Bitcoin” (2016). This documentary, directed by Christopher Cannucciari, explores the origins and evolution of Bitcoin, a decentralized digital currency. It delves into the underlying blockchain technology and discusses the potential of cryptocurrencies to disrupt traditional financial systems. The film features interviews with enthusiasts and experts, providing a comprehensive overview of the cryptocurrency landscape.

- “Money Electric: The Bitcoin Mystery” (2024). This revealing documentary dives into one of the most enduring and high-stakes mysteries in technology and finance: the origins of Bitcoin and the identity of its anonymous creator, known as Satoshi Nakamoto. It provides an in-depth analysis of the creation of Bitcoin and its implications for the future of money.

- “Generation Wealth” (2018). This documentary, directed by Lauren Greenfield, offers a personal journey and historical essay that examines the global boom-bust economy, the corrupted American Dream, and the human costs of late-stage capitalism, narcissism, and greed. It provides a critical look at materialism and wealth obsession in contemporary society.

- “Hot Money” (2021). Directed by Susan Kucera and featuring General Wesley Clark and Jeff Bridges, this documentary delves into the complexities of the global financial system, exploring how money influences climate change, military conflicts, and national security. It provides insights into global economies’ interconnectedness and financial instability challenges.

- “Inside Job” (2010). Directed by Charles Ferguson and narrated by Matt Damon, this documentary comprehensively analyzes the 2008 global financial crisis. Through extensive research and interviews with key financial insiders, politicians, and journalists, it exposes the systemic corruption within the financial industry and the consequences of deregulation.

These productions offer diverse perspectives on the world of gold, ranging from historical accounts and fictional adventures to documentaries that explore the reality of mining and the quest for this precious metal.

Legal Disclaimer

The content of this article is for informational and educational purposes only. It does not constitute financial, tax, or legal advice. Before making any investment decisions, we recommend consulting a qualified professional who can assess your personal and economic situation. Investments carry risks, and the investor is responsible for analyzing and assuming those risks.